Nvidia has turn out to be synonymous with the time period “semiconductor,” however there’s one other participant looming within the background that would emerge as a extra profitable alternative in the long term.

When it comes to the semiconductor trade, no different firm has turn out to be as well-known as Nvidia. The corporate focuses on designing graphics processing items (GPU), a singular piece of {hardware} structure that is used for all types of generative AI purposes.

With that stated, even the largest stars have their supporting forged. Whereas Nvidia will get all of the glory within the synthetic intelligence (AI) panorama, the corporate has to credit score Taiwan Semiconductor Manufacturing (TSM -0.50%) for numerous its success.

Let us take a look at what makes Taiwan Semi such a singular funding alternative within the AI realm and discover why the corporate’s long-term image seems to be extremely strong.

Exploring Taiwan Semiconductor’s place within the AI panorama

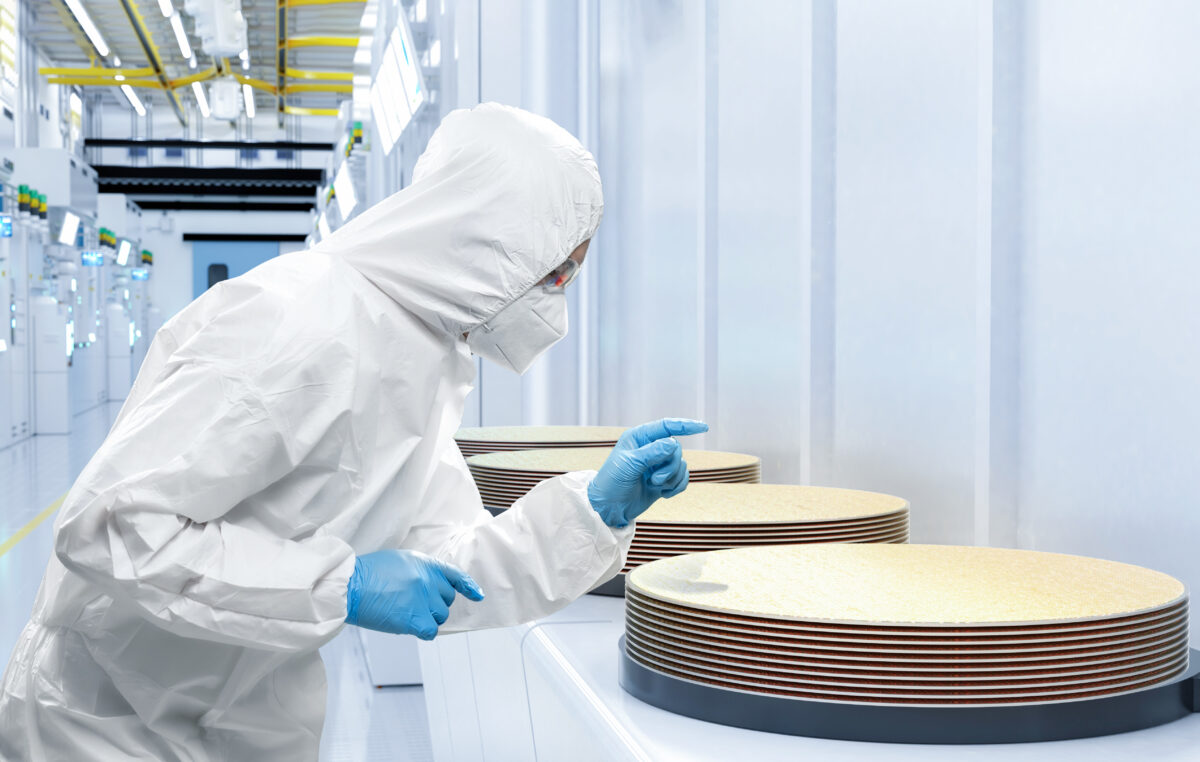

Taiwan Semiconductor specializes within the fabrication processes that deliver GPUs to life. Whereas Nvidia, Superior Micro Gadgets, and many extra design chips, these corporations outsource a lot of the manufacturing course of to TSMC.

In accordance to its annual report, Taiwan Semi works with a number of big-name semiconductor corporations and cloud computing hyperscalers together with Amazon, Broadcom, Qualcomm, Sony, and after all, AMD and Nvidia.

Picture supply: Getty Pictures

Why the long-term image seems to be strong for Taiwan Semiconductor

In accordance to Mordor Intelligence, the worldwide complete addressable market (TAM) for GPUs is anticipated to develop at a compound annual development price (CAGR) of 33% between 2024 and 2029 — reaching a dimension of $274 billion by the tip of the last decade.

Furthermore, contemplating Nvidia’s upcoming Blackwell chips and next-generation Rubin GPUs scheduled for 2026, mixed with AMD’s rival AI accelerators and upcoming launches of chipsets made by Microsoft, Meta Platforms, Amazon, and Alphabet, I feel TSMC has a chance to purchase incremental market share as demand for GPUs continues to rise.

Taking a look at Taiwan Semiconductor’s valuation

As of market shut on Dec. 20, shares of TSMC have gained practically 90% in 2024 — completely dominating the S&P 500 and Nasdaq Composite indexes. And but, even with such market-beating good points, there’s an argument to be made that shares of Taiwan Semi are undervalued.

Proper now, TSMC trades at a forward price-to-earnings multiple (P/E) of twenty-two.2. To place this into perspective, this a number of is sort of similar to the forward P/E of the S&P 500 (^GSPC 1.10%). Checked out a special means, traders are basically valuing the potential of an funding in TSMC, versus that of the broader market, to be the identical.

I solely see two respectable danger components surrounding Taiwan Semi. The primary and extra apparent matter to take into account revolves round geopolitical tensions between Taiwan and China. The second and extra refined factor to bear in mind is that TSMC’s major competitor Intel may witness some tailwinds in its personal foundry enterprise underneath the incoming Trump administration, thanks to a marketing campaign promise of investing extra in home manufacturing.

Given the alignment between TSMC’s ahead P/E and that of the S&P 500, I am questioning if traders have priced in a few of these danger components with Taiwan Semiconductor inventory.

Regardless of the case, I see an funding in TSMC as far superior to that of the broader capital markets. I feel the tailwinds fueling the AI narrative are an excessive amount of to gloss over, and I might argue that the semiconductor trade is the core engine powering the AI market, generally.

At its present valuation, TSMC appears to be an outright discount. I encourage traders with a long-term time horizon to take into account shopping for the inventory hand over fist and put together to maintain it for years to come.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Intel, Meta Platforms, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, brief February 2025 $27 calls on Intel, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.