When it comes to synthetic intelligence (AI), most traders and Wall Avenue analysts use the “Magnificent Seven” shares as a key barometer. There are good causes for this.

Microsoft has plowed billions of {dollars} into OpenAI — the developer of ChatGPT. Furthermore, demand for Nvidia‘s graphics processing items (GPUs) can present a good suggestion of the place and the way companies are exploring AI-driven use circumstances.

However, funding financial institution Goldman Sachs sees a distinct member of the Magnificent Seven as the clear-cut winner of the AI revolution up to now.

Simply days in the past, Goldman hailed Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) as the chief amongst mega-cap AI firms. The explanation? Information. Heaps and plenty of information.

Let’s break down why information is Alphabet’s aggressive benefit, and discover why now’s a profitable time to scoop up shares at a cut price valuation.

Alphabet dominates the web

There is not any query that ChatGPT has piqued the curiosity of AI lovers, company workplaces, and even college students.

Over the previous 12 months or so, one knock in opposition to Alphabet was that ChatGPT would pose a risk to conventional search habits. Contemplating that Alphabet is the dad or mum firm of web search engine Google and video-sharing platform YouTube, some turned skeptical that the firm was dealing with an existential disaster and shedding momentum when it comes to consumer preferences on the web.

Nonetheless, even in the face of rising competitors, Google and YouTube stay the two most visited web sites in the world, every receiving north of 100 billion website visits on a month-to-month foundation.

Why is Alphabet’s information so essential?

The web site visitors that Alphabet generates offers the firm with extra information factors than another competitor. In flip, Alphabet can use this information as an enter to practice its giant language mannequin (LLM), Gemini.

Hedge fund supervisor and Alphabet investor Invoice Ackman cited Alphabet’s “substantial distribution moat” as a singular characteristic for the firm to maintain its lead in the AI realm.

This permits Alphabet to develop, hone, and launch generative AI functions at a sooner tempo than different platforms. Furthermore, the firm can combine its AI-powered instruments all through its giant and increasing ecosystem — promoting, cloud computing, social media, office productiveness software program, and extra.

Alphabet inventory seems to be filth low-cost

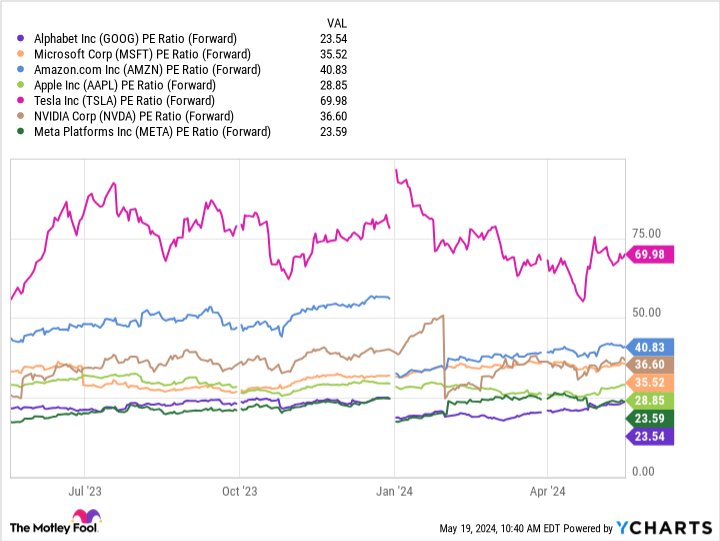

According to the chart under, Alphabet has the lowest ahead price-to-earnings (P/E) ratio amongst its Magnificent Seven friends.

My take is that traders are discounting Alphabet’s development prospects, and the cause is essentially rooted in competitors.

Certain, ChatGPT is undoubtedly fashionable, and Microsoft has witnessed some spectacular development since integrating the AI device all through its ecosystem. Furthermore, semiconductor firms will doubtless be a long-term beneficiary of the broader AI motion as secular tailwinds proceed to push demand for chips.

This does not essentially imply that Alphabet’s enterprise mannequin is in peril. The truth is, rising competitors and booming use circumstances in AI might very effectively lead to a brand new chapter in Alphabet’s development story.

I feel traders are lacking the forest for the timber right here. Alphabet is extremely well positioned to benefit from several aspects of AI. As folks proceed to depend on Google and YouTube for sources of data and leisure, Alphabet will stay as the chief in information assortment. This ought to in the end function the catalyst for the firm’s long-term AI roadmap.

To me, Alphabet inventory is filth low-cost, and the low cost in contrast to mega-cap friends is a shopping for alternative. Traders with a long-term horizon ought to think about benefiting from the valuation disparity in Alphabet inventory and scoop up some shares proper now.

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Alphabet wasn’t considered one of them. The ten shares that made the minimize might produce monster returns in the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 at the time of our advice, you’d have $652,342!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 13, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Goldman Sachs Group, Microsoft, and Nvidia. The Motley Idiot recommends the following choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

This “Magnificent Seven” Company Is Leading the Artificial Intelligence (AI) Revolution, According to Goldman Sachs (Hint: It’s Not Nvidia) was initially revealed by The Motley Idiot