The know-how sector has been one of many best-performing industries thus far in 2024 thanks largely to booming demand in synthetic intelligence (AI).

Unsurprisingly, it looks as if each tech firm is making an attempt to model itself as an AI alternative proper now. Nevertheless, one firm that’s rising as a authentic frontrunner within the AI marathon is Microsoft (NASDAQ: MSFT).

Let’s dig into how Microsoft is making a splash within the AI realm, and discover why now is a good time for long-term traders to scoop up shares.

How is Microsoft disrupting AI?

In November 2022, the know-how trade witnessed a seismic shift because the world was launched to ChatGPT. It didn’t take lengthy for ChatGPT to develop into large-scale. By January 2023, media stories had been circulating that ChatGPT had over 100 million customers on the platform.

Contemplating its widespread reputation and the sophistication of its large language model know-how, it is no coincidence that Microsoft invested $10 billion into ChatGPT’s father or mother firm, OpenAI, in January 2023.

Over the past 12 months and a half, Microsoft has built-in ChatGPT throughout its complete ecosystem. Whereas it is nonetheless within the early days, the preliminary monetary outcomes since its funding in ChatGPT have been fairly spectacular.

Are the investments paying off?

One of many greatest progress alternatives for AI normally is cloud computing. In accordance to Statista, Microsoft at the moment owns 25% of the worldwide cloud infrastructure market — second solely to Amazon. Again in April, Microsoft reported monetary outcomes for its third quarter of fiscal 2024. For the interval ended March 31, Microsoft generated $26.7 billion in its Clever Cloud unit — a rise of 21% 12 months over 12 months.

Inside the Clever Cloud phase, income from Microsoft’s Azure cloud companies grew by 31% 12 months over 12 months. Contemplating the extent of competitors amongst cloud infrastructure suppliers, I am inspired by Azure’s progress price. Furthermore, after listening to administration’s commentary through the name, traders have purpose to imagine that rather more progress may very well be on the horizon.

One of many greatest new merchandise Microsoft has launched since integrating ChatGPT into the enterprise is a digital assistant referred to as CoPilot. In accordance to administration, roughly 60% of the Fortune 500 use CoPilot.

A premium valuation properly definitely worth the value

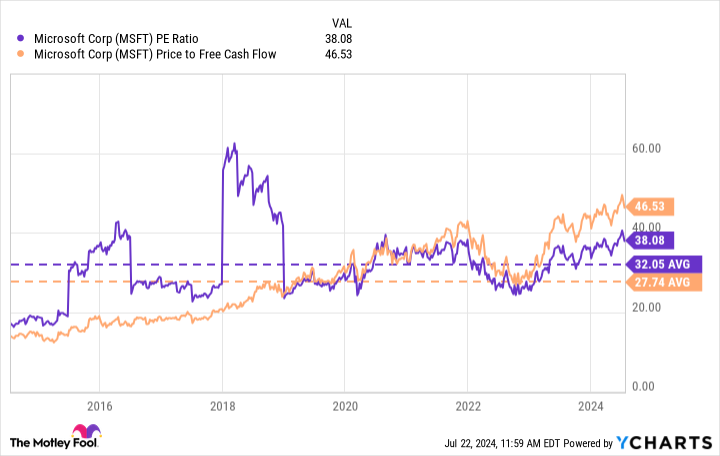

The chart beneath exhibits that Microsoft’s present price-to-earnings (P/E) ratio and price-to-free-cash-flow (P/FCF) ranges are properly above their 10-year averages.

Though these valuation ranges would possibly counsel Microsoft inventory is a bit expensive, I would encourage traders to zoom out and take into consideration the larger image.

In lower than two years, Microsoft has swiftly applied a model new AI software throughout its ecosystem. In doing so, the corporate has continued to additional speed up its cloud enterprise whereas closely penetrating the world’s largest companies with its new CoPilot assistant.

Traders who’re searching for publicity to AI ought to think about a place in Microsoft. The corporate’s ecosystem spans many alternative finish markets, together with cloud infrastructure, private computing, office productiveness, gaming, social networking, and extra. All of those areas have the potential to be fully revolutionized by AI.

To me, AI represents an fascinating new chapter in Microsoft’s evolution.

The secular tailwinds fueling the broader AI panorama counsel that the know-how is right here to keep a method or one other. Contemplating Microsoft has been a dominant pressure throughout many areas of the know-how spectrum for practically 50 years, I am satisfied that its investments in ChatGPT will guarantee it will likely be properly positioned within the AI realm for years to come.

I believe Microsoft is a uncommon breed in that traders can personal the inventory without end and profit from the corporate’s steadfast dedication to innovation and progress. For these causes, I believe traders are greatest off investing in Microsoft over a long run time horizon and holding onto the inventory.

Must you make investments $1,000 in Microsoft proper now?

Before you purchase inventory in Microsoft, think about this:

The Motley Idiot Stock Advisor analyst group simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Microsoft wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $692,784!*

Stock Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

(*1*)

*Stock Advisor returns as of July 22, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon and Microsoft. The Motley Idiot has positions in and recommends Amazon and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Spectacular Artificial Intelligence (AI) Stock to Buy Now and Hold Forever was initially printed by The Motley Idiot