-

Microchip Technology Inc (NASDAQ:MCHP) showcases strong internet revenue progress regardless of a slight decline in internet gross sales.

-

Sturdy R&D funding underpins the corporate’s dedication to innovation and market management.

-

Microchip Technology Inc’s complete product portfolio positions it properly to capitalize on business traits.

-

Regardless of aggressive pressures, MCHP maintains a robust market presence with a give attention to technical service and help.

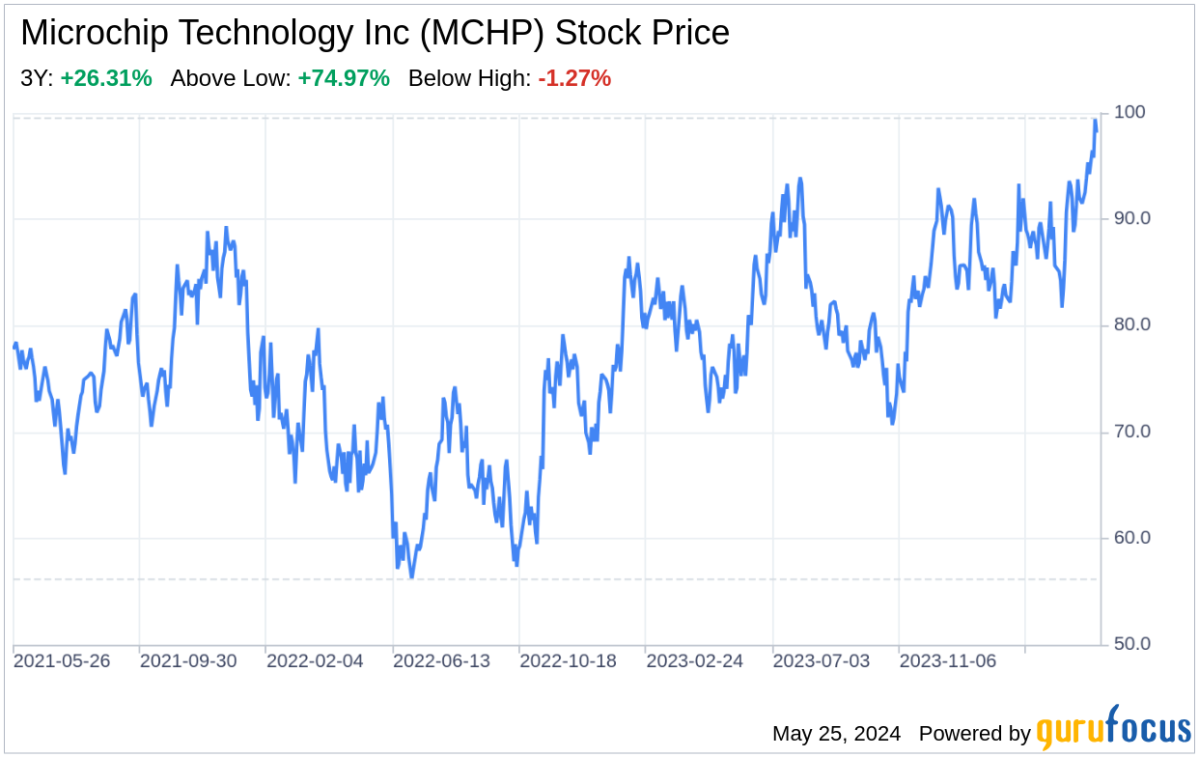

Microchip Technology Inc (NASDAQ:MCHP), a number one supplier of microcontroller and analog semiconductors, reported a internet revenue of $1,906.9 million for the fiscal yr ended March 31, 2024, in keeping with its newest 10-K submitting dated Might 23, 2024. This represents a strong enhance from the $1,285.5 million reported in 2022, showcasing the corporate’s skill to develop profitability. Nonetheless, internet gross sales noticed a slight decline from $8,438.7 million in 2023 to $7,634.4 million in 2024. Regardless of this, the corporate’s gross revenue margin remained sturdy, with a gross revenue of $4,995.7 million in 2024. Analysis and growth bills remained a precedence, with $1,097.4 million invested in 2024, indicating a dedication to innovation and future progress. The corporate’s monetary well being is additional evidenced by a stable earnings per share (EPS) progress, with primary internet revenue per widespread share rising from $2.33 in 2022 to $3.52 in 2024.

Strengths

Strong Monetary Efficiency: Microchip Technology Inc (NASDAQ:MCHP) has demonstrated a robust monetary efficiency with a major enhance in internet revenue from $1,285.5 million in 2022 to $1,906.9 million in 2024. This progress in profitability, regardless of a slight lower in internet gross sales, underscores the corporate’s operational effectivity and talent to handle prices successfully. The constant funding in analysis and growth, totaling $1,097.4 million in 2024, displays MCHP’s dedication to innovation and sustaining a aggressive edge available in the market. The corporate’s sturdy monetary place is additional supported by a wholesome EPS progress, which is indicative of its skill to generate shareholder worth over time.

Complete Product Portfolio: MCHP’s broad product portfolio, which provides a Whole System Resolution (TSS) for patrons, is a key power. This method, combining {hardware}, software program, and providers, allows the corporate to deal with disruptive progress traits equivalent to 5G, IoT, and electrical automobiles throughout varied finish markets. By offering a big portion of the silicon necessities in functions, MCHP positions itself as an indispensable companion to its clients, doubtlessly resulting in elevated buyer loyalty and recurring income streams.

Weaknesses

Income Dependence on a Few Markets: Regardless of its sturdy monetary efficiency, MCHP’s slight decline in internet gross sales suggests a possible over-reliance on sure markets or product traces. This might expose the corporate to dangers related to market volatility or shifts in shopper preferences. Diversifying its income streams may assist mitigate this weak spot and guarantee long-term stability.

Aggressive Pressures: The semiconductor business is understood for its intense competitors and speedy technological change. MCHP faces stiff competitors from each established gamers and new entrants, which may affect its market share and pricing energy. To stay aggressive, the corporate should repeatedly innovate and differentiate its product choices whereas managing prices successfully.

Alternatives

Rising Market Traits: MCHP is well-positioned to capitalize on rising market traits such because the growing adoption of IoT, the transition to 5G expertise, and the expansion of electrical automobiles. By leveraging its TSS method and specializing in these progress areas, MCHP has the chance to increase its buyer base and enhance its market share.

Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions may present MCHP with entry to new applied sciences, markets, and clients. These collaborations may improve the corporate’s product choices, speed up innovation, and create further income streams.

Threats

International Financial Uncertainty: MCHP’s operations and monetary efficiency could possibly be adversely affected by international financial uncertainty, together with commerce tensions, geopolitical conflicts, and public well being crises. These elements may disrupt provide chains, have an effect on buyer demand, and result in elevated prices and lowered profitability.

Technological Disruption: Speedy technological developments and modifications in buyer necessities may render MCHP’s present merchandise out of date. The corporate should preserve a robust give attention to R&D and keep forward of technological traits to keep away from being displaced by extra modern opponents.

In conclusion, Microchip Technology Inc (NASDAQ:MCHP) reveals a robust monetary basis and a strategic give attention to innovation and market traits. Whereas the corporate faces challenges equivalent to aggressive pressures and international financial uncertainty, its complete product portfolio and potential for strategic partnerships current vital alternatives for progress. MCHP’s skill to navigate these dynamics will likely be essential in sustaining its aggressive place and driving future success.

This text, generated by GuruFocus, is designed to supply basic insights and isn’t tailor-made monetary recommendation. Our commentary is rooted in historic information and analyst projections, using an neutral methodology, and isn’t meant to function particular funding steerage. It doesn’t formulate a suggestion to buy or divest any inventory and doesn’t take into account particular person funding targets or monetary circumstances. Our goal is to ship long-term, basic data-driven evaluation. Bear in mind that our evaluation may not incorporate the latest, price-sensitive firm bulletins or qualitative info. GuruFocus holds no place within the shares talked about herein.

This text first appeared on GuruFocus.