Main expertise firms have principally reported optimistic quarterly outcomes, driving the robust adoption of their AI-powered choices. This uptrend is anticipated to proceed via the remainder of the yr and past. Microsoft Corp. (NASDAQ: MSFT) and Worldwide Enterprise Machines Company (NYSE: IBM) are among the many prime AI gamers, serving to companies harness the facility of the expertise.

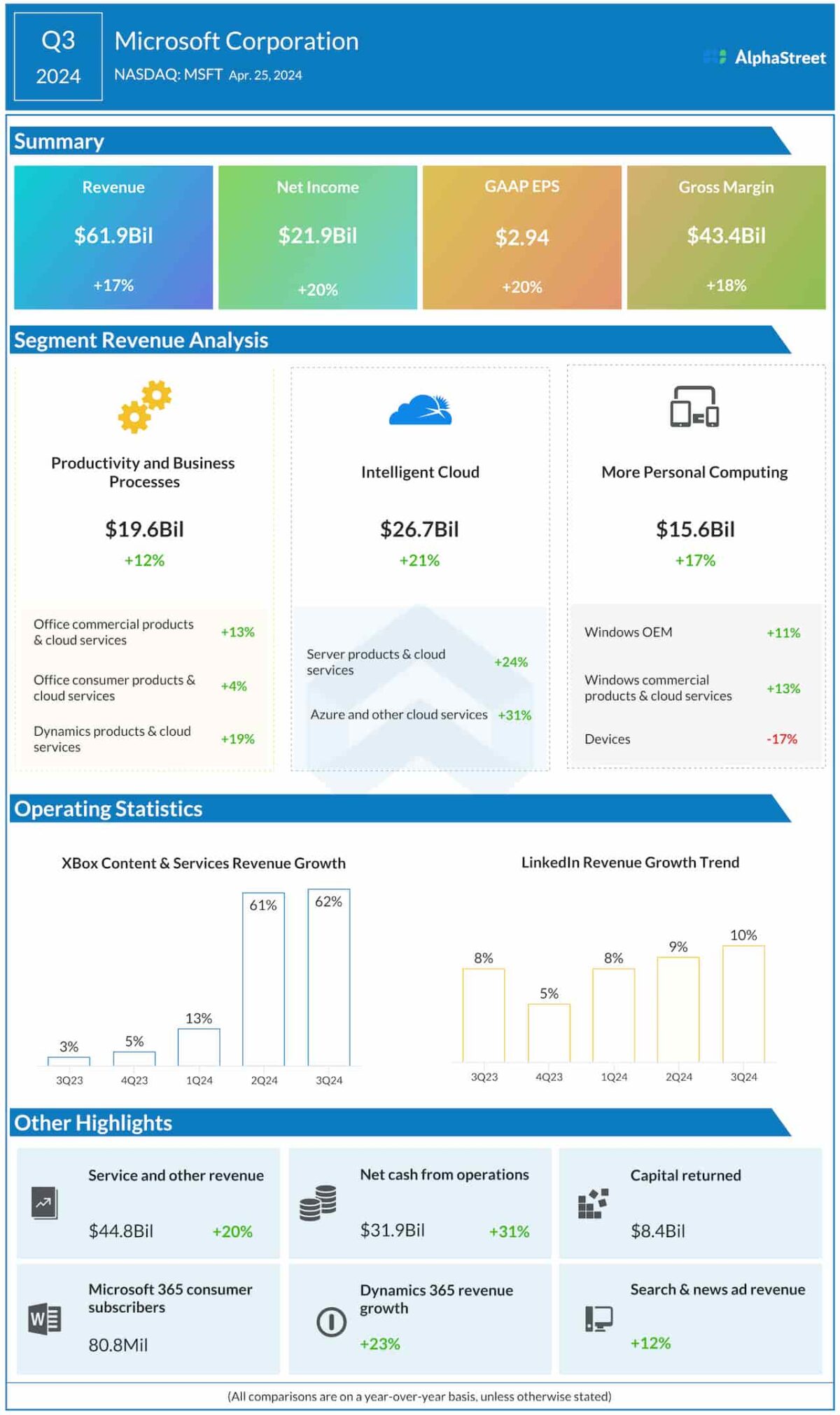

Microsoft’s cloud companies have registered double-digit income development to this point in fiscal 2024, supported by aggressive AI integration throughout the board. In the latest quarter which ended on March 31, 2024, Microsoft Workplace Merchandise & Cloud Providers income grew in double digits year-over-year, and Server Merchandise and Cloud Providers income rose a powerful 24%. As a consequence, complete revenues grew 17% yearly to about $62 billion. At $22 billion or $2.94 per share, Q3 web revenue was up 20% from the prior-year interval. Then again, gadget revenues, primarily comprising the corporate’s Floor computer systems, declined 17% amid continued slowdown in demand. One other weak space is the Xbox gaming console — 31% fall in income — although the content material facet of the gaming division noticed robust development aided by Activision titles.

Person-Pleasant

Microsoft has built-in AI throughout its current and new companies, each within the business and client divisions, leading to an all-new person expertise. AI instruments have made MS purposes extra user-friendly and customary duties simpler, driving broader adoption, due to the prevalence of its merchandise out there. Prospects with comparatively smaller initiatives would discover Microsoft’s subscription-based mannequin cost-effective. By infusing AI throughout all layers of its tech stack, Microsoft has a extra sensible income mannequin permitting it to effectively seize worth from AI choices.

The corporate’s stock grew at an accelerated tempo all through final yr, commonly setting new information. It entered 2024 on a excessive be aware and at one level Microsoft surpassed Apple because the world’s Most worthy firm. The upswing continued and the stock crossed the $450 mark for the primary time and reached a new excessive this week. The market is buoyed by the corporate’s groundbreaking partnership with OpenAI and the mixing of ChatGTP into its enterprise. Going by the administration’s innovation-focused development technique, the stock has extra room for development. MSFT seems like a compelling funding for the long run, with the potential to generate robust returns.

Sluggish Development

Within the case of IBM, the tech large’s cloud-based Consulting and Software program segments — which collectively account for three-fourths of complete revenues — delivered steady efficiency in latest quarters. In the meantime, top-line development was restricted by weak spot in different areas, primarily the Infrastructure enterprise that includes servers, software program, cloud, and safety companies. The consequences of AI integration are but to be mirrored within the infrastructure phase.

In Q1 2024, revenues edged as much as $14.5 billion as a rise in Software program revenues was partially offset by softness within the different enterprise divisions. Adjusted revenue jumped 24% year-over-year to $1.68 per share within the first quarter. Gross revenue margin elevated by 80 foundation factors year-over-year to 53.5%, underscoring the corporate’s excessive operational effectivity.

In the course of the quarter, the corporate signed an settlement to accumulate HashiCorp for about $6.4 billion, extending Pink Hat’s capabilities and strengthening its footprint within the hybrid cloud market. After ending the quarter with a wholesome working money circulation of $4.2 billion, the corporate seems well-positioned to government its development technique.

Customization

IBM has a lengthy observe document of conducting analysis and improvement in artificial intelligence expertise. Its AI options, together with the progressive Watson Suite, play a key position in rising person engagement and increasing buyer base. The specialties embody industry-specific choices and choices for intensive customization, which make the merchandise best for large-scale initiatives. Nevertheless, IBM’s AI initiatives are but to translate into revenues in a significant method.

Whereas IBM’s stock had a optimistic begin to 2024 and climbed to a 10-year excessive, its efficiency has not been very spectacular after that. It suffered a selloff after the discharge of This autumn earnings and traded sideways since then. In the meantime, the shares have gained about 24% up to now twelve months. Relating to investing in IBM, the absence of any indicators of the stock’s revival from the present lows requires warning.