Artificial intelligence (AI) is creating a considerable quantity of worth for buyers proper now. It helped catapult Nvidia from a market cap of round $360 billion to greater than $3.3 trillion over the previous 18 months alone, and it continues to propel shares of Microsoft and Amazon greater, in addition to many others.

However leaping onto the AI bandwagon is not a silver bullet for organizations dealing with deeper challenges. Snowflake (NYSE: SNOW) is a first-rate instance: Although it is in a improbable place to construct AI services and products, its underlying enterprise continues to battle with slowing income development and sizable monetary losses.

In truth, whereas Snowflake inventory is down 67% from its all-time excessive, an extra 50% drop from its present value is not out of the query.

Snowflake is in a fantastic place to construct AI companies

Snowflake created its Knowledge Cloud to assist organizations break down the information silos that type after they use a number of totally different suppliers of cloud services (equivalent to Amazon Internet Providers and Microsoft Azure). The Knowledge Cloud permits them to mixture all their information, and gives them with highly effective analytics software program to assist them extract as a lot worth from it as doable.

Contemplating Snowflake focuses on information administration, it is within the excellent place to ship AI services and products to its prospects. Final yr, it launched Cortex AI, which is a platform companies can use to develop their very own AI functions utilizing a mix of their very own information, and ready-made massive language fashions.

Plus, Cortex AI gives companies a variety of AI instruments developed in-house by Snowflake. Doc AI can extract information from unstructured sources like contracts, and Common Search allows all staff — even these in non-technical roles — to find beneficial insights from throughout their group’s information utilizing pure language queries, with no programming information required.

Snowflake’s income development is constantly decelerating

Snowflake generated $789.6 million in product income throughout its fiscal 2025 first quarter (which ended April 30). That was a 34% enhance from the prior-year interval. Nevertheless, its development charge on that metric constantly decelerated for the reason that firm got here public 4 years in the past:

|

Interval |

Product Income Progress (YOY) |

|

|---|---|---|

|

Q1 Fiscal 2022 |

110% |

|

|

Q1 Fiscal 2023 |

84% |

|

|

Q1 Fiscal 2024 |

50% |

|

|

Q1 Fiscal 2025 |

34% |

|

Knowledge supply: Snowflake. YOY = Yr over yr.

Snowflake is not chopping again on growth-generating prices like advertising and marketing or analysis and improvement, which might assist clarify this slowdown. In truth, its working bills surged 31.6% yr over yr throughout fiscal Q1.

A few different issues are at play. Snowflake’s web income retention charge was 128% in Q1, so its established prospects had been, on common, spending 28% extra money with it than that they had within the prior-year interval. In one sense, that is a very good signal. Nevertheless, web income retention steadily declined from its peak of 179% on the finish of fiscal 2022. That straight feeds into income development.

Second, the speed at which Snowflake is including new prospects is slowing. That’s comprehensible, as a result of it already landed 709 of the Forbes International 2000 (the biggest 2,000 firms on this planet). It is unclear how lots of the others really want the companies Snowflake gives, which is vital as a result of these massive organizations may theoretically develop into a few of its highest-spending prospects.

The mixture of Snowflake’s slowing income development and its aggressive spending led to a web lack of $317 million in fiscal Q1, which was a 40.5% bigger loss than it booked within the year-ago interval. That’s a uncooked deal for buyers who’re watching the corporate burn truckloads of money with out concrete outcomes — no less than for now. It is doable Snowflake’s development will reaccelerate sooner or later on the again of its AI initiatives.

Even after its 67% drop, Snowflake inventory stays costly

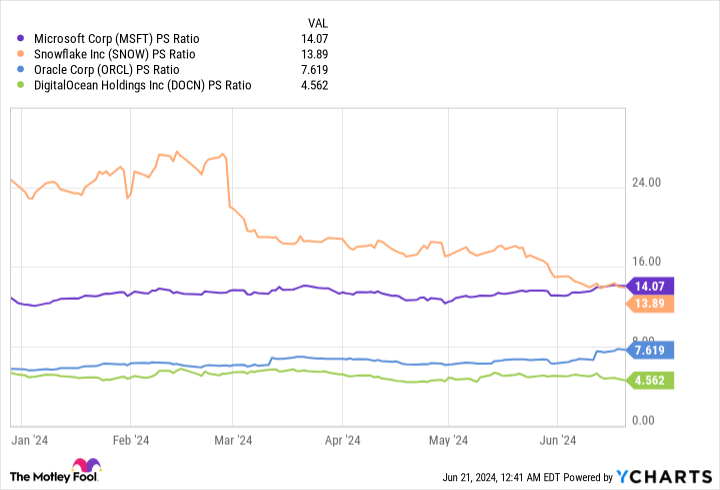

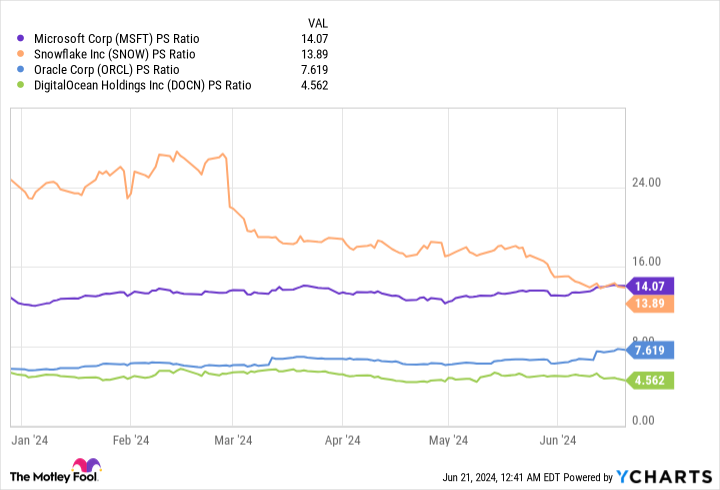

Primarily based on Snowflake’s $3 billion or so in trailing 12-month income and its present market capitalization of slightly below $42 billion, its inventory trades at a price-to-sales (P/S) ratio of about 13.9. That makes Snowflake one of the vital costly cloud software program shares buyers can purchase — and that is after the 67% decline it has already sustained.

This is how Snowflake’s P/S ratio compares to another firms within the cloud software program and AI area:

Snowflake principally trades on the similar P/S valuation as Microsoft. That is not precisely cheap contemplating that Microsoft operates one of many largest cloud platforms (Azure) on this planet and is a recognized leader in AI software already.

Oracle developed a portfolio of cloud-based functions to assist companies throughout a number of industries enhance effectivity and streamline operations. Oracle has additionally develop into a frontrunner in AI information middle infrastructure. The corporate’s income solely grew by 3% in its most lately reported quarter, however that weak point was purely as a result of a provide situation — its order backlog (remaining efficiency obligation) soared by a whopping 44% to a record-high $98 billion, which is a greater indicator of demand.

Lastly, DigitalOcean is a number one supplier of cloud and AI companies to small and mid-sized companies.

Snowflake’s P/S ratio is difficult to justify when measured towards these shares. It is even much less enticing when you think about the corporate is guiding for product income development to decelerate additional to simply 24% in its fiscal 2025.

Subsequently, buyers cannot ignore the chance that Snowflake inventory may fall by round half from its present stage, which might carry its P/S ratio nearer to the ratios of Oracle and DigitalOcean.

Must you make investments $1,000 in Snowflake proper now?

Before you purchase inventory in Snowflake, contemplate this:

The Motley Idiot Stock Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Snowflake wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $775,568!*

Stock Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

(*1*)

*Stock Advisor returns as of June 10, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, DigitalOcean, Microsoft, Nvidia, Oracle, and Snowflake. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

1 Artificial Intelligence (AI) Stock Down 67% That Could Get Slashed In Half Again was initially printed by The Motley Idiot