The proliferation of synthetic intelligence (AI) has given an enormous enhance to expertise shares previously 12 months, which is clear from the 30% beneficial properties clocked by the Nasdaq-100 Know-how Sector index throughout this era. However not all firms on this sector have benefited from the adoption of AI.

Twilio (NYSE: TWLO) is a kind of names, as shares of this supplier of cloud communications providers are down 11% previously 12 months. The corporate’s slowing development due to weak buyer spending has performed a central position in its poor exhibiting on the inventory market.

Nonetheless, Twilio inventory has began gaining some momentum of late. However can this cloud stock maintain heading increased? Let’s discover out.

Twilio may very well be blessed by the rising AI adoption in touch facilities

Twilio’s software programming interfaces (APIs) allow firms to construct communications instruments and keep in contact with their prospects via numerous channels reminiscent of textual content, electronic mail, voice, chat, and video. The corporate’s providers permit prospects to change conventional contact facilities, which require investments in actual property and gear reminiscent of computer systems and servers, with cloud-based contact facilities.

The great half is that the marketplace for cloud-based contact facilities is anticipated to generate $86 billion in income in 2029 as in contrast to this 12 months’s estimate of $26 billion — a compound annual development price of 27%. AI adoption in name facilities can be anticipated to develop at a wholesome annual tempo of 23% via 2030, producing $7 billion in income on the finish of the last decade as in contrast to $1.6 billion this 12 months.

Twilio has generated $4.2 billion in income previously 12 months, indicating that each cloud contact facilities and the proliferation of AI inside the similar are going to be tailwinds for the corporate. Extra importantly, it has already began providing AI instruments to prospects.

On its Could earnings conference call, administration stated that Twilio has made “progress on plenty of our AI merchandise.” The corporate has already launched Agent Copilot, which would be the first of the three AI-focused merchandise to be embedded into its communications options this 12 months.

Twilio says that Agent Copilot will give buyer affiliate brokers deeper perception into buyer conduct by analyzing real-time information, thereby “automating and enhancing agent productiveness whereas decreasing decision instances.”

Beta testing by Twilio’s purchasers means that they’re certainly in a position to cut back the time spent whereas addressing the wants of their very own prospects. Within the phrases of CEO Khozema Shipchandler:

Agent Copilot and unified profiles are at present in public beta, and prospects, like [online college] Universidad UK, are already leveraging these capabilities inside their contact facilities. Consequently, they’ve pushed a discount in deal with time by 30%. And through the use of our embedded AI automation instruments, they have been in a position to deflect 70% of assist instances in simply two months.

Extra importantly, the corporate’s Buyer AI platform, which it made accessible to purchasers within the third quarter of 2023, can be witnessing an enchancment in adoption. As such, Twilio ought to ideally have the ability to win a much bigger share of purchasers’ spending sooner or later because it launches extra AI-focused merchandise.

A possible turnaround may very well be within the playing cards

Income within the first quarter of 2024 was up 7% 12 months over 12 months on an natural foundation, whereas total income elevated 4% to $1.05 billion. The corporate exited the quarter with 313,000 lively buyer accounts, which was up from 300,000 in the identical interval final 12 months.

Nonetheless, its dollar-based internet retention price got here in at 102%, not a robust determine. This metric compares the spending by Twilio’s prospects throughout 1 / 4 to the spending by those self same prospects in the identical quarter a 12 months in the past. A studying of greater than 100% implies that its prospects adopted extra of its choices or prolonged their use of their present ones. So the online retention price within the first quarter signifies that current prospects’ spending barely improved.

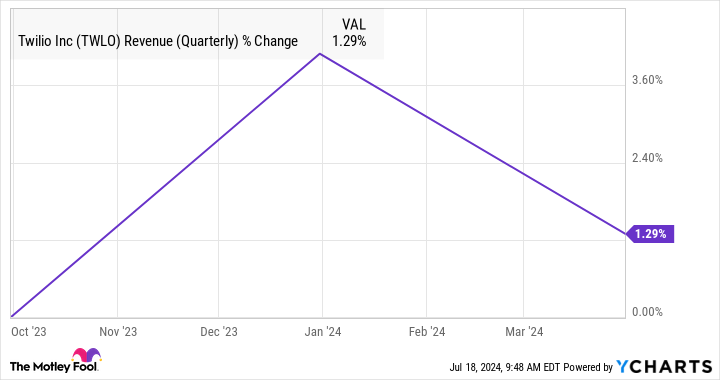

For the total 12 months, administration is forecasting a rise of 5% to 10% in its natural income. Analysts count on its total prime line to leap 4.6% in 2024 to $4.35 billion. However because the adoption of Twilio’s AI-centric providers improves, its income development can be anticipated to get higher, as proven by the next chart.

The chart additionally tells us that analysts have elevated their income expectations for 2026 of late. And earnings are forecast to improve at an annual price of just about 20% for the subsequent 5 years.

This potential enchancment in Twilio’s development is the rationale traders ought to take into account shopping for this cloud inventory, because it trades at simply 2.6 instances gross sales proper now, a reduction to the U.S. expertise sector’s common of 8.4.

Additionally, it is buying and selling at 21 instances ahead earnings, which once more represents a pleasant low cost to the Nasdaq-100’s ahead earnings a number of of 30 (utilizing the index as a proxy for tech shares). Twilio carries a 12-month median worth goal of $69, in accordance to 34 analysts masking the inventory, which might be a 16% leap from present ranges. The 12-month Avenue-high worth goal stands at $110, suggesting a possible leap of 85%.

If Twilio’s development certainly begins bettering thanks to AI, there’s a stable probability that it will likely be in a position to put its underperformance behind and ship wholesome beneficial properties, which is why traders can take into account shopping for it whereas it’s nonetheless low cost.

Must you make investments $1,000 in Twilio proper now?

Before you purchase inventory in Twilio, take into account this:

The Motley Idiot Stock Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Twilio wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $722,626!*

Stock Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

(*1*)

*Stock Advisor returns as of July 15, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Twilio. The Motley Idiot has a disclosure policy.

1 Incredibly Cheap Artificial Intelligence (AI) Stock to Buy Before It Skyrockets was initially revealed by The Motley Idiot