After two years of nice enthusiasm for generative synthetic intelligence, a urgent question is beginning to preoccupy the main gamers: can the subject generate adequate earnings to offset its substantial working prices? Many doubts come up. David Cahn, a Companion at Sequoia Capital, just lately raised what he calculated as “AI’s $600B Question”, explaining that the AI bubble is reaching a tipping level and navigating what comes subsequent will be important.

In keeping with Cahn, the math does not add up, a declare he helps with a easy calculation. He doubled Nvidia’s income projections to account for the prices related to working information facilities, which require chips, electrical energy, buildings, and water for cooling. He then doubled this quantity once more to replicate the revenue margins of finish customers (e.g., startups buying AI computing from corporations like Microsoft, Amazon, and Google). This calculation suggests that the subject ought to generate annual revenues of $600 billion. Nevertheless, even with the optimistic assumption that every of the expertise giants—Alphabet, Microsoft, Apple, Amazon, and Meta—will generate $10 billion yearly from AI, and that smaller corporations reminiscent of Oracle, ByteDance, Alibaba, Tencent, and Tesla every generate $5 billion in annual income, there’s nonetheless a $500 billion hole between bills and revenues in the subject. The place will the cash come from?

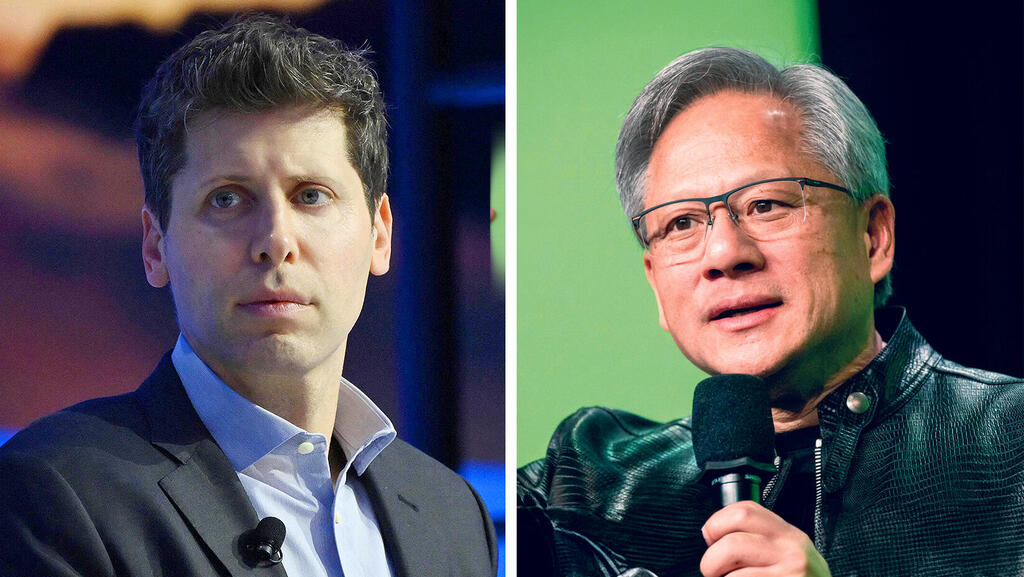

1 View gallery

OpenAI CEO Sam Altman (left), Nvidia CEO Jensen Huang

(Images: Bloomberg, Andrew Caballero-Reynolds/AFP)

Jeremy Grantham, an investor identified for predicting the monetary crises of 2000 and 2008, urged final yr that synthetic intelligence is a bubble that could quickly deflate. He added that expertise shares have reached an “eye-popping peak” and will seemingly expertise a pointy decline.

How eye-popping? In 2023, practically $190 billion in investments flowed into AI. A complete of 1,812 startups raised funds that yr—a 40% enhance in comparison with 2022, based on a report by Stanford HAI. With the publication of monetary experiences for the first quarter in April, all the main expertise corporations introduced elevated investments in the subject: Meta raised its forecast for AI bills this yr to $10 billion; Alphabet introduced it could make investments $12 billion (or extra) every quarter, primarily in information facilities; and Microsoft, which invested $14 billion in the final quarter, expects this determine to extend “considerably.”

Capital Group estimates that the expertise giants alone will make investments $189 billion in 2024—over a fifth of all investments amongst S&P 500 corporations. Whereas the tech giants can afford this resulting from sturdy revenues and income, what about the smaller corporations?

The numbers are staggering, doubts are rising, and indicators of issues are surfacing with finish customers. Stability AI, a outstanding startup in the subject with a valuation of over $1 billion at the finish of 2022 and over $250 million raised, has reportedly solely generated $11 million in 2023 whereas incurring $153 million in working prices. The firm just lately introduced layoffs of 10% of its workforce. Emad Mostaque, the former CEO of Stability AI, who resigned in March, predicted final yr that this could be the greatest bubble of all time, dubbing it the “dot AI” bubble.

This month, the alarmed group was joined by the first large institutional participant – Goldman Sachs, which printed the first sober report of its sort on the synthetic intelligence trade. For the financial institution, the question is bigger than $600 billion. “Tech giants and past are set to spend an estimated $1 trillion on AI capex in coming years. Will this funding repay? And if it doesn’t, what does that imply for companies and traders?” they wrote.

Though the report tries to offer a posh and balanced image, the normal feeling is pessimistic. In keeping with Daron Acemoglu, an economics professor from MIT who’s quoted in the report, synthetic intelligence will automate lower than 5% of duties in the subsequent decade, and will contribute a measly 0.9% to GDP progress. Head Goldman Sachs International Fairness Analysis Jim Covello provides that the expertise isn’t designed to unravel complicated issues that would justify the excessive prices.

Though the report makes an attempt to current a balanced view, the total sentiment is pessimistic. Daron Acemoglu, an MIT economics professor quoted in the report, predicts that AI will automate lower than 5% of duties in the subsequent decade and contribute solely 0.9% to GDP progress. Jim Covello, head of Goldman Sachs International Fairness Analysis, provides that AI expertise isn’t designed to unravel complicated issues that would justify its excessive prices.

This marks a pointy distinction to a Goldman Sachs report printed in Might, which estimated that generative AI would enhance U.S. productiveness by 9% and GDP by 6.1% inside a decade. Capital Economics predicts that the bubble could burst as early as 2026, resulting in a decade of disappointing common annual inventory positive factors of 4.3%.

Funding funds and banks accountable for injecting important capital into AI over the previous two years are reluctant to make use of the time period “bubble,” as they continue to be caught up in the hype. For instance, SoftBank just lately introduced a choice for investing in AI corporations over different methods, together with share buybacks. SoftBank has beforehand made high-profile investments, reminiscent of its $12 billion funding in WeWork, which failed. In June, Masayoshi Son, founder of SoftBank, described the earlier funding spherical as a “warm-up spherical.”

A bubble requires cautious consideration, measured funding, and a crucial perspective in direction of the valuations of sure corporations. The present state of affairs bears a hanging resemblance to the dot-com bubble, with parallels in the fast worth will increase of corporations like Nvidia and Cisco throughout the late Nineteen Nineties, simply earlier than the bubble burst. The expertise sector’s dominance in the S&P 500, making up 32% of the index—its highest charge since the dot-com period—additional fuels these comparisons. Solely three corporations—Apple, Microsoft, and Nvidia—account for a fifth of the index, which raises considerations.

Relating to a possible bubble, the essential question isn’t when or the way it will burst, however what will stay afterward. The dot-com bubble, regardless of inflicting important harm, ultimately cleared the sector of ineffective corporations and laid the groundwork for future technological developments. The AI bubble, whereas nonetheless evolving, holds nice potential. At present’s AI merchandise, reminiscent of text-to-image turbines and chatbots, are well-liked with customers, however the large capital isn’t but discovered of their instant makes use of by CPAs, builders, or advertisers.

Do these makes use of justify the monumental working prices? Not but. Nevertheless, the data gained in growing these merchandise, the information facilities, and the infrastructures supporting them might create new alternatives and sustainable merchandise after the bubble bursts.