Artificial intelligence (AI) has the likelihood to grow to be one in all the largest and most impactful technological improvements of our time. The functions of the know-how are nonetheless in the very early innings, as is the buildout of the infrastructure wanted to check large language models (LLMs) and run AI inference.

Let’s take a look at three shares set to be AI winners that you could purchase and maintain onto for the subsequent decade.

1. Nvidia

Nvidia (NASDAQ: NVDA) has been one in all the largest AI winners to this point, however that does not imply it will not proceed to be a long-term winner. The corporate’s graphic processing models (GPUs) have grow to be the spine of the infrastructure buildout to assist energy AI functions. As firms rush to create their very own AI functions, demand for Nvidia’s chips has been via the roof.

To keep up its lead in the house, Nvidia has sped up its innovation cycle, and it’s trying to introduce new chip structure on an accelerated schedule. At the similar time, the firm’s Compute Unified Gadget Structure (CUDA) software program platform is a differentiator for the firm and has helped it create a large moat. The software program platform is usually what builders are taught on to program GPUs, serving to make Nvidia’s chips and software program platform the business commonplace.

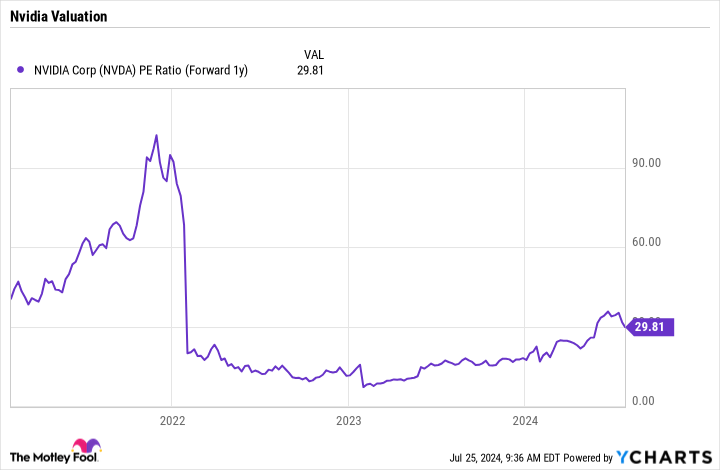

Regardless of the inventory’s sturdy efficiency, Nvidia nonetheless trades at a lovely valuation, with a ahead price-to-earnings (P/E) ratio of underneath 30 based mostly on 2025 analyst estimates. Given its progress potential, that could be a discount.

2. Alphabet

Do not let the slide in Alphabet’s (NASDAQ: GOOGL) (NASDAQ: GOOG) inventory following its second-quarter outcomes idiot you. The corporate posted sturdy outcomes that present it’s set to grow to be an AI winner.

The corporate’s cloud computing section, Google Cloud, is making nice strides, seeing Q2 income progress of 29% to $10.4 billion, as the section advantages from builders utilizing its AI infrastructure and generative AI options. Importantly, although, it is a very fixed-cost enterprise the place the firm has simply gained the obligatory scale. As such, profitability is beginning to soar, with Q2 working revenue going from $395 million a yr in the past to $1.2 billion.

In the meantime, the fears that AI may negatively influence Google Search have to this point been unfounded, with the firm seeing search income leap 14% final quarter. Alphabet is simply starting to faucet into the energy of AI with its search, growing AI overlays to reply some queries. After some preliminary hiccups, customers are starting to interact with the new function, and the firm is in the early days of monetizing (benefiting from) these AI overviews. The corporate plans to introduce new search and purchasing adverts with the format quickly.

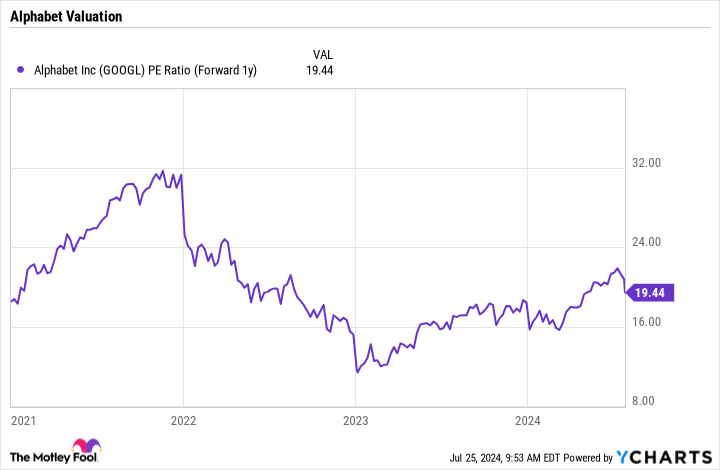

Buying and selling at a ahead P/E of underneath 20 based mostly on 2025 analyst estimates, the inventory is one in all the most cost-effective mega-cap tech shares on the market and an ideal inventory to purchase and maintain for the long run.

3. Adobe

Whereas chip shares associated to constructing out AI infrastructure have been the huge early AI winners, software program firms have the potential to be sturdy AI winners as nicely. One such firm embracing AI and main the cost is Abobe (NASDAQ: ADBE), which holds a dominant place in the artistic software program house with applications corresponding to Photoshop and InDesign. Additionally it is the main PDF resolution firm via its Acrobat applications.

The corporate has been pushing the use of AI into its merchandise, with such AI options as generative fill, textual content to picture, generative form fill, and generative take away, utilizing the Firefly AI fashions that it has developed. Adobe continues to be in the early days of monetizing AI, as proper now, it lets customers trial its AI capabilities for free earlier than they’ve to purchase generative credit. The corporate ought to discover a higher to method to revenue from its AI capabilities in the future, however proper now, it’s serving to drive stable progress.

In the meantime, the firm’s AI-powered Adobe Categorical app, which helps create graphics and movies for social media, seems to be prefer it may very well be a long-term AI winner. Social media is clearly a giant enterprise, and such a device has lots of potential. Adobe launched an all-new model of the Categorical app early final quarter and noticed month-to-month lively customers double quarter over quarter because of this.

Adobe’s Doc Cloud section, dwelling to Acrobat, in the meantime, drove a few of its greatest progress final quarter, with income for the section up 19% to $782 million in fiscal Q2. The outcomes have been powered by the introduction of its Acrobat AI assistant add-on subscription.

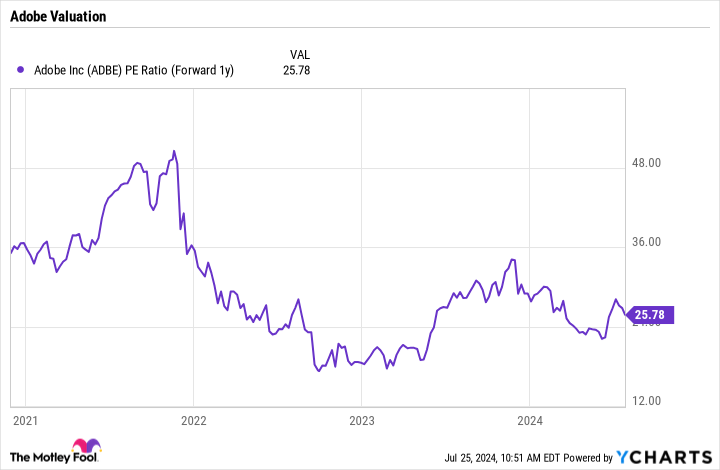

Adobe trades at an affordable ahead P/E of underneath 26 based mostly on fiscal 2025 estimates, and the inventory seems to be poised to be a longer-term winner traders should buy and maintain.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize may produce monster returns in the coming years.

Think about when Nvidia made this record on April 15, 2005… when you invested $1,000 at the time of our suggestion, you’d have $692,784!*

Inventory Advisor offers traders with an easy-to-follow blueprint for success, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 22, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends Adobe, Alphabet, and Nvidia. The Motley Idiot has a disclosure policy.

3 Artificial Intelligence Stocks You Can Buy and Hold for the Next Decade was initially revealed by The Motley Idiot