Artificial intelligence (AI) is a red-hot theme in the inventory market proper now, and whereas there’s a ton of hype, many corporations are discovering tangible and extremely beneficial use instances for the expertise.

Duolingo (NASDAQ: DUOL) is the world’s largest digital language training platform, and its enterprise was an unbelievable success earlier than AI got here alongside. Nonetheless, the firm is utilizing it to create thrilling new options for its customers, and it is resulting in new income streams.

The inventory is down 29% from the all-time excessive it set earlier this 12 months. Here is why that presents a terrific alternative for buyers to purchase in.

Picture supply: Getty Pictures.

Utilizing AI to boost language studying

Duolingo is a mobile-first platform, so it locations language classes at the fingertips of virtually anyone with a smartphone. Its classes are gamified and interactive, which is a departure from conventional classroom-based studying.

Throughout the second quarter of 2024, the platform had 103.6 million month-to-month lively customers, which was up 40% from the year-ago interval. That development price represents an acceleration from the first quarter when its person base grew 35%, which actually highlights Duolingo’s constructive momentum.

The variety of customers paying a month-to-month subscription to unlock extra options rose 52% 12 months over 12 months to eight.0 million. That already spectacular development tempo may rise going ahead because of Duolingo Max, the firm’s latest (and most costly) subscription tier.

Max provides two AI-powered options: Clarify My Reply, which gives every person with personalised suggestions primarily based on their errors, and Roleplay, which permits customers to apply their conversational expertise with a chatbot in the language of their selection. Duolingo has been working on AI for a number of years, however these new options run on OpenAI‘s highly effective GPT-4 fashions, which allowed the firm to launch them extra rapidly.

Duolingo Max launched final 12 months, and it is solely obtainable to round 15% of lively customers in 27 international locations to this point. Nonetheless, it is an necessary step in the firm’s mission to ship a studying expertise able to rivaling a human tutor. Duolingo will steadily roll out Max to extra customers over time, and the firm says it would reveal new details about the product at its Duocon convention subsequent month.

Duolingo’s income and revenue proceed to develop quickly

Second-quarter income climbed 41% to $178.3 million final quarter, exceeding the excessive finish of administration’s forecast ($177.5 million). The sturdy end result prompted administration to extend its full-year income steerage by $2.8 million at the excessive finish of the vary, to $738.3 million.

Duolingo additionally reported vital progress on the backside line. The corporate continues to fastidiously handle its prices, rising whole operating expenses simply 14.7% 12 months over 12 months. That contributed to net income‘s surge from $3.7 million to $24.4 million.

Merely put, Duolingo is proving to buyers it would not should burn vital quantities of money to take care of sturdy development throughout its enterprise. In truth, in contrast to many tech corporations in the client area, Duolingo spends little or no cash on advertising. It was the firm’s smallest working expense throughout Q2 at $20.2 million, which represented simply 18% of its whole working prices.

In the previous, Duolingo advised buyers that as much as 90% of its person acquisition is natural, which implies it comes through avenues like phrase of mouth and free social media posts. Throughout Q2, the firm stated its natural (unpaid) social media impressions soared 190% from the year-ago interval.

Why Duolingo inventory is a purchase on the dip

An estimated 2 billion persons are studying a overseas language worldwide, so Duolingo has an extended runway for development primarily based on its present month-to-month lively person base. Plus, if the firm achieves its mission to ship a digital studying expertise that rivals human tutors, it would provide an unprecedented worth proposition to college students, which could even immediate them to substitute their bodily classes for the Duolingo app.

AI will probably be the secret to delivering that have. Duolingo’s customers full over 1 billion workout routines each single day, which gives the firm with mountains of beneficial information it might probably use to enhance its AI options, making them extra responsive and extra correct over time.

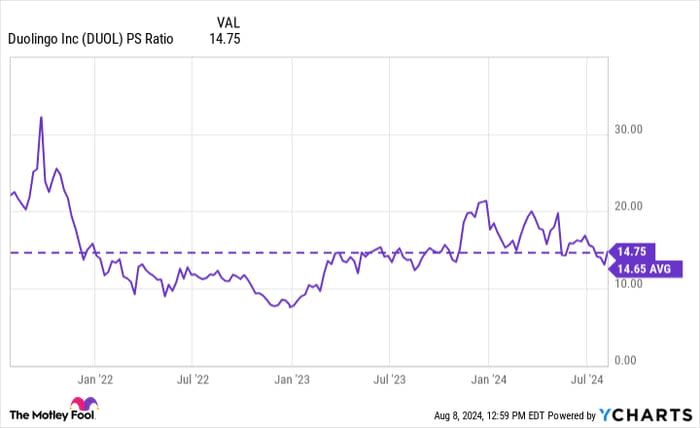

Duolingo inventory is at present buying and selling at a price-to-sales (P/S) ratio of 14.7, which is sort of precisely in step with its common because it went public in 2021. In different phrases, Duolingo inventory is neither low-cost nor costly proper now, not less than relative to its historic valuation ranges.

Knowledge by YCharts.

Nonetheless, if the firm delivers $738.3 million in income throughout 2024 as anticipated, that offers its inventory a ahead P/S ratio of 11.0 (primarily based on the firm’s present market capitalization of round $8.2 billion). That means Duolingo inventory must rise over 30% between now and the finish of this 12 months simply to take care of its common P/S ratio of 14.6.

However buyers who purchase the inventory right this moment needs to be focusing on the long run. The corporate is delivering blistering development, regardless of the very restricted availability of its AI-powered Max subscription. Because it rolls out additional, Duolingo may ship extra report outcomes on the high and backside traces.

Must you make investments $1,000 in Duolingo proper now?

Before you purchase inventory in Duolingo, contemplate this:

The Motley Idiot Stock Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Duolingo wasn’t one in every of them. The ten shares that made the minimize may produce monster returns in the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 at the time of our advice, you’d have $641,864!*

Stock Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

(*1*)

*Stock Advisor returns as of August 6, 2024

Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Duolingo. The Motley Idiot has a disclosure policy.