I’ve acquired three gadgets this week, responding to readers’ ideas and questions.

First is a follow-up to last week’s column about how recent Cuyahoga County property assessments created large, unvoted tax hikes for most individuals. I argued for metropolis and county governments to roll again a tax price to return the entirety of that improve. I mentioned we knew of none doing that.

I heard from a council member in a single suburb who mentioned he and his colleagues in a couple of different West Facet cities are, certainly, exploring tax aid. Sadly, he’s aiming it solely at the aged and the needy. He seeks a loophole in Ohio legislation to keep up the improve from companies, in addition to middle- and upper-class householders.

Good attempt, however unsuitable. I don’t assume a loophole exists, however the intention violates the fundamental ideas of Ohio property taxes.

Prefer it or not, on this state, voters management property taxes. Governments that want money should make their case and persuade voters to approve them. As a result of these taxes can’t rise with inflation, each few years the governments want more cash and ask us once more. Often, voters approve.

The system places a citizen test on governments. We reject taxes in the event that they waste cash. Additionally, bear in mind, with the cities, most of their budgets come from earnings taxes, which rise with wages, giving them built-in inflation safety.

I supply all this to clarify why suburbs seeking to roll again the large tax improve err by limiting it to aged and needy householders. Give all of it again. Or face ire whenever you subsequent ask for a tax improve. The readers I heard from are livid about the unvoted tax improve and glad our newsroom is talking up for them.

Matter two: Readers have requested a few disclosure on some tales that they have been written with the help of artificial intelligence.

We’re experimenting to find out whether or not AI would possibly assist us generate tales about areas we don’t cowl, primarily the area’s many municipalities. We accumulate information releases about gadgets that some would possibly discover attention-grabbing and use AI to transform them into tales in our writing model. A reporter is at the keyboard all through the course of, studying and enhancing the outcomes. Nothing will get printed with out a reporter’s hand on it.

To this point, the outcomes are combined. Some tales, resembling these about issues to do, are broadly learn. Others, not a lot. The subsequent part of the experiment might be utilizing AI to research what goes on in authorities conferences, in the hunt for sizzling subjects that our reporters would possibly discover.

Our coverage on AI disclosure is easy. If AI produces any textual content in a narrative we publish, regardless of how quick, we’ll connect a word. But when we use AI for fundamental reporting resembling knowledge evaluation – the similar method we use Microsoft Excel, for instance – then I see no have to disclose that. Reporters use many instruments, however the reporters do the analyzing.

I’m enthusiastic about AI as a result of I imagine it is going to relieve reporters of tedious duties, liberating them to pursue meatier subjects.

Lastly, I wrote a few weeks ago about bringing another puppy home, a 12 months after we misplaced Ella, our golden retriever. A bunch of you requested me what the pet’s title is, and as at all times with me, the reply is a narrative.

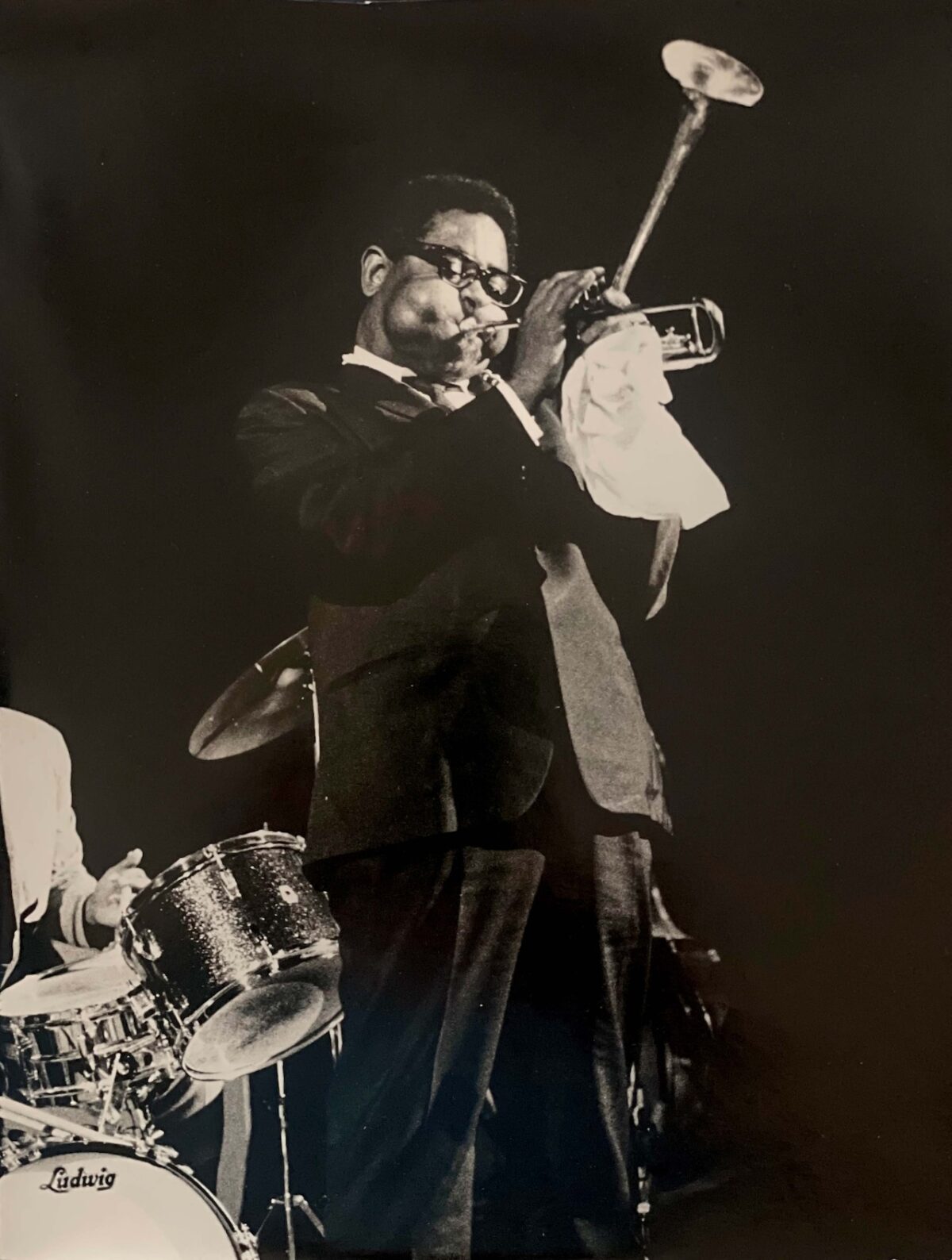

Our earlier three goldens have been named Hoagy, Satchmo and Ella, for Hoagy Carmichael, Louis Armstrong and Ella Fitzgerald. Some years in the past, we determined to call the subsequent for Dizzy Gillespie. In the event you’ve frolicked with golden retrievers, you would possibly agree Dizzy is the good title. Our daughter thought so, anyway, and instantly tried to put declare to the concept, leading to years of good-natured debate at vacation gatherings.

As we mentioned getting a pet earlier this 12 months, nevertheless, my spouse and I vacillated. Can Dizzy be a lady’s title? What about Etta – an in depth relative of the title Ella – for Etta James? Or Billie, for Billie Holiday?

Then the universe knocked.

Lisa Garvin is a neighborhood member of our newsroom Editorial Board and a panelist on our weekday Today in Ohio podcast, the place we dissect the information of the day. Her late dad, Dr. Harry C. Garvin, was an avid jazz fan, spending numerous time with his spouse, Doris, in Cleveland and New York jazz golf equipment in the Fifties, ‘60s and ‘70s. He additionally was an avid photographer, taking images of many jazz greats. Lisa mentioned her home had a darkroom the place her dad did all his work, and the dwelling is filled with framed pictures of such giants as Miles Davis and Duke Ellington.

At some point earlier this summer season, earlier than I had talked about to anybody that we would get one other canine, Lisa, figuring out I really like jazz, provided me considered one of her dad’s prints.

Dizzy Gillespie. It’s the picture at the prime of this column.

Once I introduced it dwelling and confirmed my spouse Kathy, we agreed the debate was over. When the universe knocks, you reply the door. Lisa’s mother, who owns the rights to the picture, gave me permission to make use of it right here. And he or she instructed me she, too, likes the title Dizzy.

Jazz followers would possibly admire that for years to return, with any luck, two phrases will ring out often in our dwelling.

“Hey Diz!”

I’m at cquinn@cleveland.com

Thanks for studying