Spending on synthetic intelligence (AI) infrastructure has been strong in 2024, which is obvious from the terrific demand for knowledge middle chips and server options that has been driving spectacular progress in income and earnings for a number of corporations.

The excellent news for corporations benefiting from the AI increase is that infrastructure spending on this space is about to continue to grow in 2025 as nicely. In accordance to Barclays, hyperscale cloud corporations are on monitor to enhance their 2024 capital expenditures by 41%, adopted by an estimated enhance of 15% subsequent 12 months. Nevertheless, the funding financial institution added that the rise in capex subsequent 12 months could possibly be a lot bigger than 15%, thanks to increased spending on graphics processing items (GPUs) and customized AI chips being deployed in AI servers.

What’s extra, market analysis agency Dell’Oro Group estimates spending on knowledge middle infrastructure is on monitor to enhance at a compound annual progress charge (CAGR) of 24% via 2028.

All this explains why traders would do nicely to purchase shares of Broadcom (NASDAQ: AVGO) and Dell Applied sciences (NYSE: DELL), two corporations which are direct beneficiaries of the surge in AI-focused knowledge middle spending.

Let’s take a look at the the explanation why shopping for these two names proper now might prove to be a worthwhile transfer for 2025 and past.

1. Broadcom

Broadcom makes application-specific built-in circuits (ASICs), that are customized chips designed for performing particular duties. Whereas GPUs are presently being deployed in large numbers to practice massive language fashions (LLMs) thanks to their large parallel computing energy, McKinsey estimates that ASICs can be used for performing nearly all of AI workloads by 2030.

That is not stunning, as ASICs are purpose-built chips which are extra power environment friendly compared to general-purpose computing chips similar to GPUs. And since they’re designed to carry out particular duties, ASICs carry a velocity and efficiency benefit over general-purpose chips. This explains why JPMorgan estimates that the marketplace for ASICs, which is presently value $20 billion to $30 billion, might develop at an annual charge of greater than 20% in the long term.

JPMorgan provides that Broadcom is the dominant participant in ASICs, with an estimated market share of 55% to 60%. The corporate is about to generate $12 billion in income within the present fiscal 12 months from gross sales of its customized AI accelerators and Ethernet networking chips deployed in AI servers. That might be practically triple the $4.2 billion income Broadcom generated from promoting AI chips final 12 months.

The corporate expects to end the continued fiscal 12 months 2024 (which is able to finish in early November) with $51.5 billion, which signifies that AI will account for 23% of its prime line. That might be a pleasant enchancment from final 12 months, when AI accounted for 14% of its income.

Broadcom’s AI income is rising at a a lot quicker tempo than the marketplace for customized AI chips, as acknowledged by JPMorgan earlier. That is as a result of Broadcom’s networking chips are additionally witnessing wholesome demand. The corporate’s networking income elevated a formidable 43% 12 months over 12 months within the earlier quarter.

Broadcom administration mentioned on the September earnings conference call that gross sales of its Ethernet switches jumped 4x from the year-ago interval thanks to demand from hyperscale prospects. Traders ought to word that the information middle switching market is getting a pleasant increase due to AI, with Dell’Oro predicting that it might double in measurement over the following 5 years and generate $80 billion in annual income.

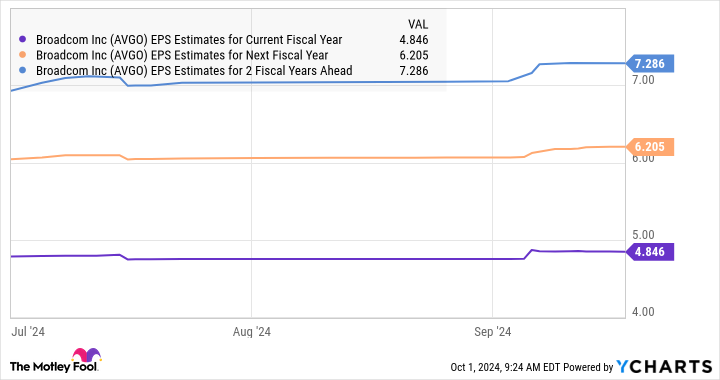

As such, Broadcom appears able to sustaining a formidable tempo of progress in the long term. Analysts predict the corporate’s backside line to enhance at an annual charge of 20% over the following 5 years. Nevertheless, they’ve been growing their expectations of late.

So, there’s a likelihood that Broadcom’s earnings progress might outpace Wall Road’s expectations sooner or later, which is why it will be a good suggestion for traders to purchase this AI inventory earlier than it jumps increased following spectacular beneficial properties of 60% in 2024.

2. Dell Applied sciences

Dell is one other firm that has witnessed an enchancment in its progress thanks to the elevated spending on AI infrastructure. Extra particularly, growing demand for AI servers has been a tailwind for Dell, driving spectacular progress within the firm’s infrastructure options group (ISG) via which it sells server and storage merchandise.

The corporate’s income within the second quarter of fiscal 2025 (which ended on Aug. 2) elevated 9% 12 months over 12 months to $25 billion. Nevertheless, the corporate’s ISG enterprise grew at a a lot quicker tempo of 38% and delivered a document income of $11.6 billion. Inside the ISG enterprise, Dell mentioned its servers and networking merchandise witnessed a terrific year-over-year enhance of 80% to $7.7 billion.

The corporate shipped $3.1 billion value of AI servers final quarter, and acquired $3.2 billion value of latest orders from cloud service suppliers (CSPs). Extra importantly, Dell mentioned its “AI server pipeline expanded throughout each tier 2 CSPs and Enterprise prospects once more in Q2 and now has grown to a number of multiples of our backlog.”

That is not stunning, because the AI server market is witnessing excellent progress. This market might clock annual income progress of 18% via 2032, producing an annual income of $183 billion on the finish of the forecast interval. Not surprisingly, Dell mentioned it’s within the early innings of the AI alternative, which is why there’s a strong likelihood that the sturdy progress of its ISG enterprise will begin driving the needle in a extra significant means for the corporate sooner or later.

Dell’s fiscal 2025 income steerage of $97 billion can be a ten% enchancment from the earlier 12 months. For comparability, the corporate’s income was down 14% in fiscal 2024. So AI has already began driving an enchancment in Dell’s fortunes, and that development is anticipated to proceed sooner or later thanks to the extra AI-related alternative within the type of the non-public laptop (PC) market.

All this explains why Dell’s earnings are anticipated to enhance at an annual charge of virtually 11% over the following 5 years. That might be an enormous enchancment over the 1.5% annual earnings erosion the corporate has witnessed up to now 5 years.

Lastly, Dell’s ahead earnings a number of of simply 15 makes shopping for the inventory a no brainer proper now, because it represents a reduction to the Nasdaq-100 index’s ahead earnings a number of of 29 (utilizing the index as a proxy for tech shares). Dell inventory has recorded spectacular beneficial properties of 55% in 2024, and it has the potential to fly increased thanks to the AI-driven turnaround in its enterprise.

Must you make investments $1,000 in Broadcom proper now?

Before you purchase inventory in Broadcom, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and Broadcom wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $752,838!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

JPMorgan Chase is an promoting associate of The Ascent, a Motley Idiot firm. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends JPMorgan Chase. The Motley Idiot recommends Barclays Plc and Broadcom. The Motley Idiot has a disclosure policy.

2 Top Artificial Intelligence (AI) Stocks to Buy Before 2025 was initially revealed by The Motley Idiot