The Worldwide Energy Company (IEA) has predicted that Artificial Intelligence (AI) and knowledge facilities will sharply improve the demand for renewable energy. The web increment of renewable energy era for AI will doubtless triple to 262 terawatt-hours (TWh) by 2026 in contrast to 2023, and the share of AI demand in renewable energy era is predicted to double to 17.9%.

The rise in renewable energy demand from the AI and semiconductor sectors is essentially fueled by the robust decarbonization efforts of worldwide Massive Tech corporations. RE100, a world initiative of over 400 corporations, goals to meet 100% of its electrical energy demand with renewable sources by 2050. The progress of South Korean RE100 members is negligible, with corporations like SK Hynix reaching solely a 30% renewable energy share and Samsung falling beneath 10%.

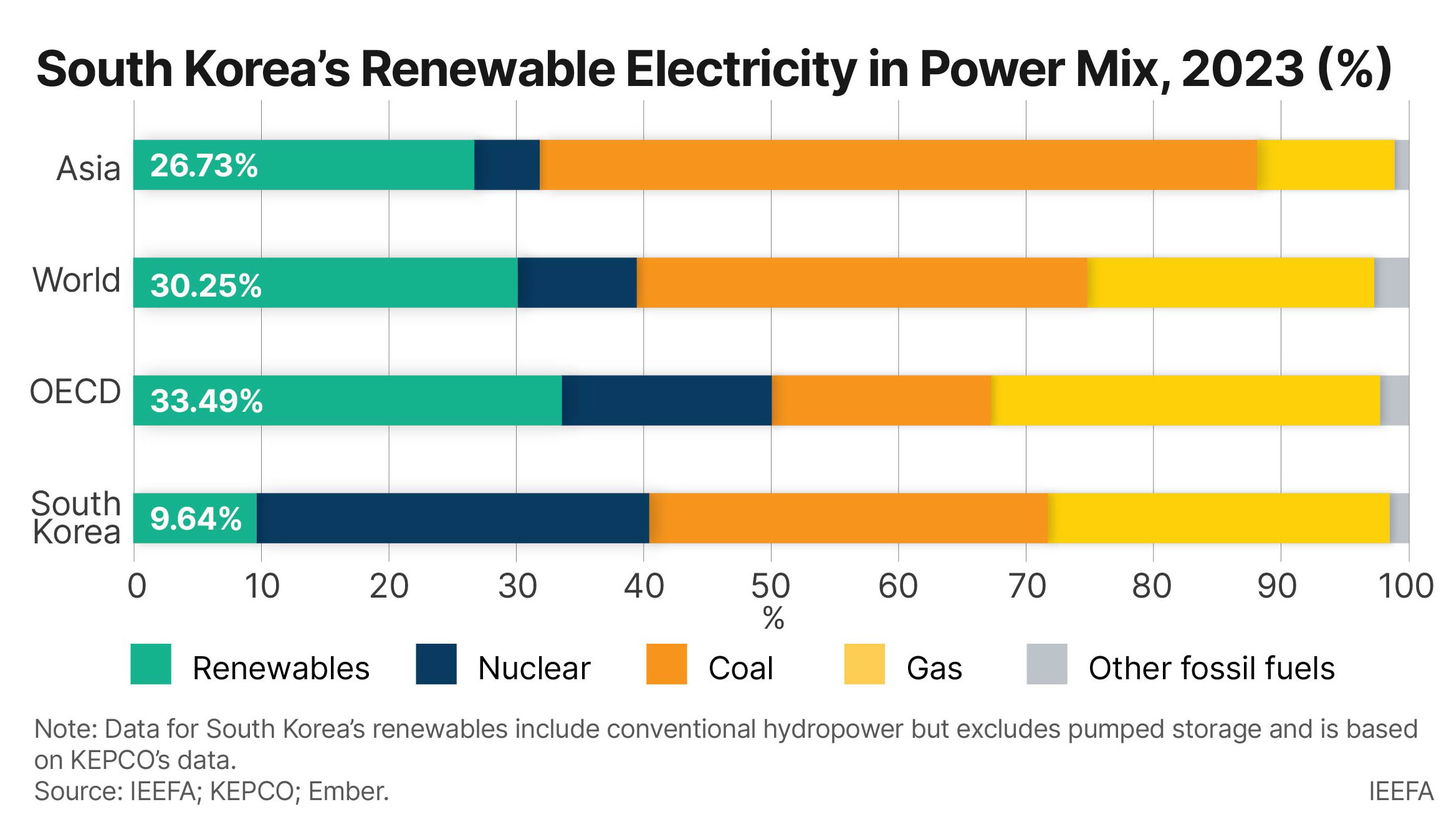

South Korea’s lagging renewable energy adoption additional delays RE100 progress. In 2023, less than 10% of the nation’s electrical energy era was from renewable sources, falling far wanting the world (30.25%) and Asia (26.73%) averages. Renewable energy accounted for lower than 6% of South Korea’s whole energy provide in 2022. Regardless of a relatively excessive proportion of nuclear, South Korea’s electrical grid carbon depth was about 430 grams of carbon dioxide per kilowatt-hour (gCO2e/kWh), at par with Japan and Singapore, and above america.

Headwinds from fossil fuel utilization within the AI & semiconductor sectors

In contrast to the speedy adoption of renewable energy in international industries, South Korean corporations equivalent to SK E&S, Hanwha Energy, POSCO International, GS E&R, and Hanyang plan to construct a mixed capability of round 4,700 megawatts (MW) of recent liquefied pure fuel (LNG) fired energy vegetation, together with Mixed Warmth and Energy (CHP) for semiconductor clusters, AI knowledge facilities, and varied industrial complexes.

Moreover, South Korea’s 11th Basic Plan for Long Term Electricity Supply and Demand (BPLE) guideline continues prioritizing greenhouse fuel (GHG) emitting, LNG-fired energy and nuclear energy from unproven Small Modular Reactors (SMRs), which is dear and solely a near-term answer.

Utilizing LNG-fired electrical energy and warmth to fuel semiconductor clusters and AI knowledge facilities might expose South Korea to substantial industry-trade and finance-capital risks amid strengthening decarbonization developments, such because the RE100 initiative, Europe’s Carbon Border Adjustment Mechanism (CBAM), and varied Scope 1, 2, and 3 reporting rules.

Semiconductors make up greater than 20% of South Korea’s whole exports. The U.S. is the fifth largest export vacation spot for South Korean semiconductors and is house to 428 RE100 member corporations. There could be important penalties if main U.S. fabless corporations have been to swap chip suppliers from South Korean corporations to others in quest of decrease embedded carbon for his or her merchandise.

Whatever the end result of the upcoming U.S. presidential election, upcoming bipartisan carbon tax-related bills, such because the Clear Competitors Act (CCA), PROVE IT Act, International Air pollution Price Act, and Market Alternative Act, are most certainly to be handed. These payments might additional erode the market share of excessive carbon-intensive South Korean corporations within the U.S.

The CBAM, proposed in 2021, aimed to stop “carbon leakage” by taxing imported items into Europe primarily based on embedded carbon emissions, together with iron, metal, aluminum, cement, hydrogen, electrical energy, and fertilizer. When this mechanism contains the semiconductor and AI sectors in its scope, excessive carbon-intensive South Korean corporations will face substantial monetary penalties.

The CBAM is a carbon tariff that doubtlessly equalizes carbon pricing between the European Union (E.U.) and non-E.U. international locations. If different international locations undertake related mechanisms and the scope of CBAM expands, it could lead on to a convergence in carbon costs throughout totally different international locations. South Korean producers would then face larger working prices related to utilizing fossil fuel-based electrical energy and warmth procurement. Concurrently, their exports could be topic to upward value changes due to the carbon depth.

Moreover, from 2024 onwards, the Worldwide Monetary Reporting Requirements Sustainability Requirements (IFRS S2) launched obligatory disclosure of Scope 3 emissions, which additionally applies to the South Korean semiconductor sector. Scope 3 emissions, as outlined by the GHG Protocol, symbolize the broadest class of GHG emissions, encompassing all oblique emissions all through a corporation’s worth chain. Numerous nationwide jurisdictions are contemplating increasing corporations’ provide chain reporting to embrace Scope 3. As soon as these rules come into impact, South Korean AI and semiconductor corporations with excessive GHG emissions might face difficulties procuring feedstocks and elements as upstream suppliers would request the carbon footprint of those producers for their very own Scope 3 reporting. Corporations that buy South Korean chips would wish to add the carbon depth of these merchandise to their Scope 3 reporting. Thus, downstream end-users might prioritize sourcing chips from decrease emissions producers to cut back their carbon footprint.

Tripling renewable energy to safeguard nationwide competitiveness

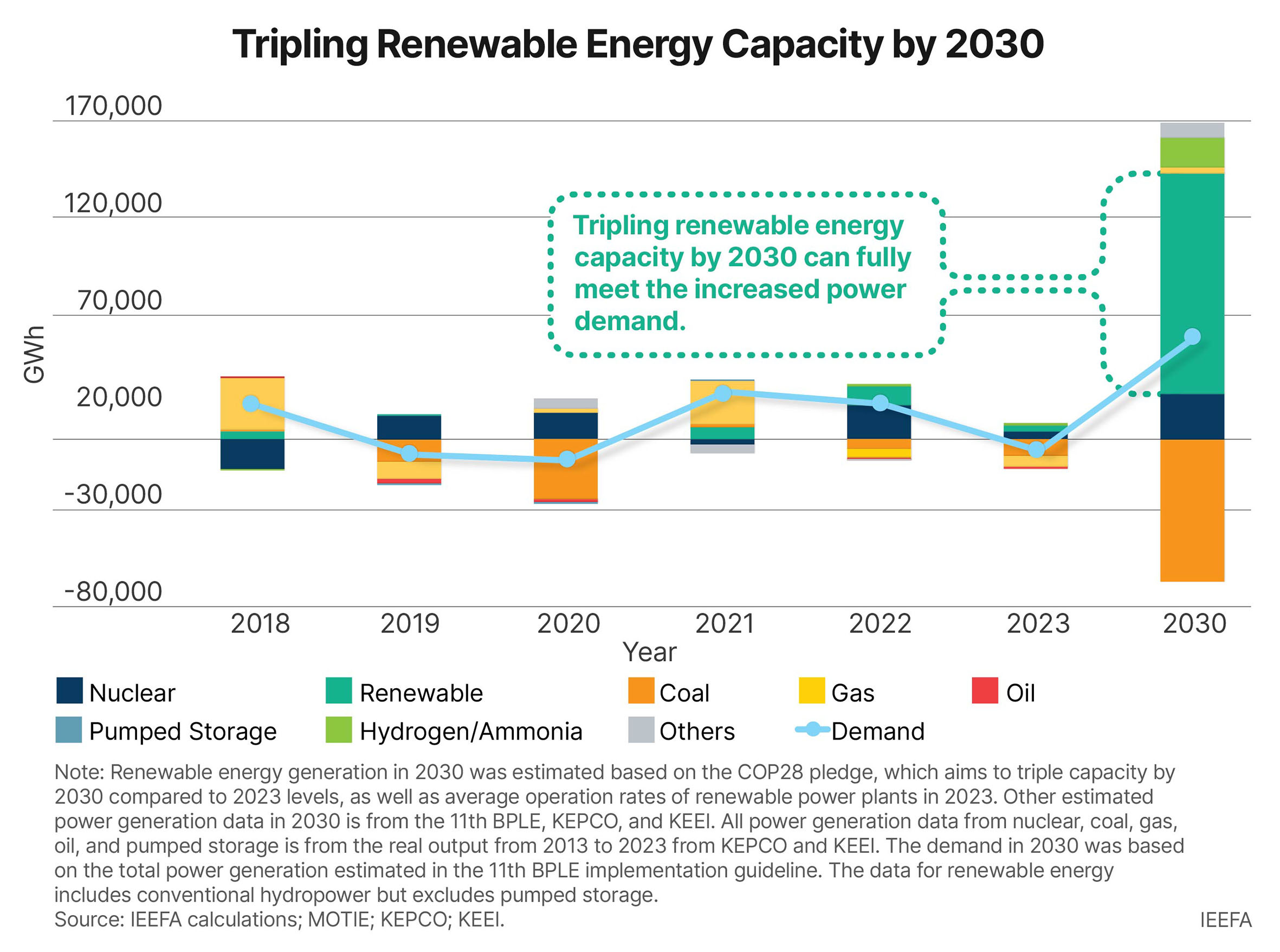

By tripling its renewable energy, as pledged on the 2023 United Nations Local weather Change Convention (COP28), South Korea can meet the rising electrical energy demand from rising semiconductor clusters and AI-driven knowledge facilities and stay globally aggressive.

In accordance to IEEFA’s analysis, tripling renewable energy capability by 2030 might totally meet the projected electrical energy demand from the AI and semiconductor sectors, assuming present energy plant buildout plans proposed within the 11th BPLE stay on observe.

The web increment of renewable energy era in contrast to 2023 might attain 113,434 gigawatt hours (GWh) by 2030. This projected degree of renewable energy era could be greater than enough to meet the anticipated web improve in energy demand, estimated to be round 53,168GWh in 2030.

Consequently, renewables might fulfill the extra energy necessities of high-growth industries and contribute to the general electrical energy combine whereas serving to South Korea meet its Paris Settlement commitments. This echoes IEA’s projection that low-carbon electrical energy will meet all further demand by 2026.

South Korea, a nation propelled by speedy financial development and technological development, was anticipated to develop into a renewable energy transition chief alongside the U.S., Europe, China, and Japan. Renewable energy might provide better provide stability and autonomy backed by an ample and decentralized useful resource distribution system.

Nevertheless, South Korea nonetheless depends closely on imported fossil fuels and lags at the very least 15 years behind different international locations’ goal of assembly the 30% renewable power threshold.

Renewable energy is rising because the frontline for nationwide competitiveness. Utilizing fossil fuel-based energy to fuel rising AI and semiconductor sectors will jeopardize industrial competitiveness and undermine geopolitical affect, nationwide safety, entry to financing, and public well-being. It’s important for South Korea to acknowledge the price of lacking out on the energy transition and to handle business dangers by guaranteeing an accelerated renewable energy adoption.