Philippe Laffont’s hedge fund, Coatue Administration, has been scooping up shares of Taiwan Semiconductor for a number of consecutive quarters.

Billionaire investor Philippe Laffont is the founding father of Coatue Administration, one in all Wall Road’s most prestigious hedge funds. Beneath, I am going to discover a few of the extra attention-grabbing strikes Coatue has made as of late because it pertains to the agency’s synthetic intelligence (AI) positions.

To find this data, I’ve reviewed the agency’s Form 13F type. It is an extremely great tool for curious traders as a result of it offers an in depth account of shopping for and promoting exercise by institutional traders each quarter.

Coatue Administration’s attention-grabbing transfer

In the course of the second quarter, Coatue bought 1.1 million shares of chip inventory Taiwan Semiconductor Manufacturing (TSM 10.75%) — rising its stake by 10% and bringing its whole place to 11.4 million shares.

On the floor, this will appear to be a secular or apparent transfer. In any case, semiconductor stocks have been a few of the largest winners for the reason that AI revolution kicked off a few years in the past. However this is the place issues get just a little curious — take a look at the desk beneath, and see how Coatue has been treating Nvidia inventory.

| Class | Q2 2023 | Q3 2023 | This fall 2023 | Q1 2024 | Q2 2024 |

|---|---|---|---|---|---|

| Nvidia Shares Held | 46.5 million | 45.4 million | 43.2 million | 13.9 million | 13.8 million |

Information supply: Hedge Comply with. Chart by writer.

For the previous yr, Coatue has been a net seller of Nvidia stock. All of the whereas, the fund has almost doubled its stake in Taiwan Semiconductor (often known as TSMC), rising its place from 6.8 million shares on the finish of the second quarter of 2023 to over 11 million shares at the moment.

Why TSMC could also be extra engaging than Nvidia

On the floor, promoting Nvidia inventory proper now might sound counterintuitive. The corporate is on the forefront of the AI motion, thanks, largely, to its blossoming graphics processing models (GPU) enterprise and information heart providers. Furthermore, with Nvidia’s new Blackwell series GPUs projected to be one more residence run for the corporate, why would anybody even contemplate promoting the inventory proper now?

For my part, the reply revolves across the long-term narrative. A lot of Nvidia’s largest clients — similar to Microsoft, Amazon, Alphabet, Meta Platforms, and Tesla — are all investing heavily in their own AI infrastructures. Whereas many of those firms will most likely stay core clients of Nvidia, there is a cheap argument to be made that the corporate’s rocket-ship-style progress goes to hit some turbulence as new chipsets hit the market.

It is this very assemble, nevertheless, that would bode properly for Taiwan Semiconductor. The corporate already manufactures merchandise for Amazon, Nvidia, Superior Micro Gadgets, Intel, Broadcom, Sony, Qualcomm, and lots of extra.

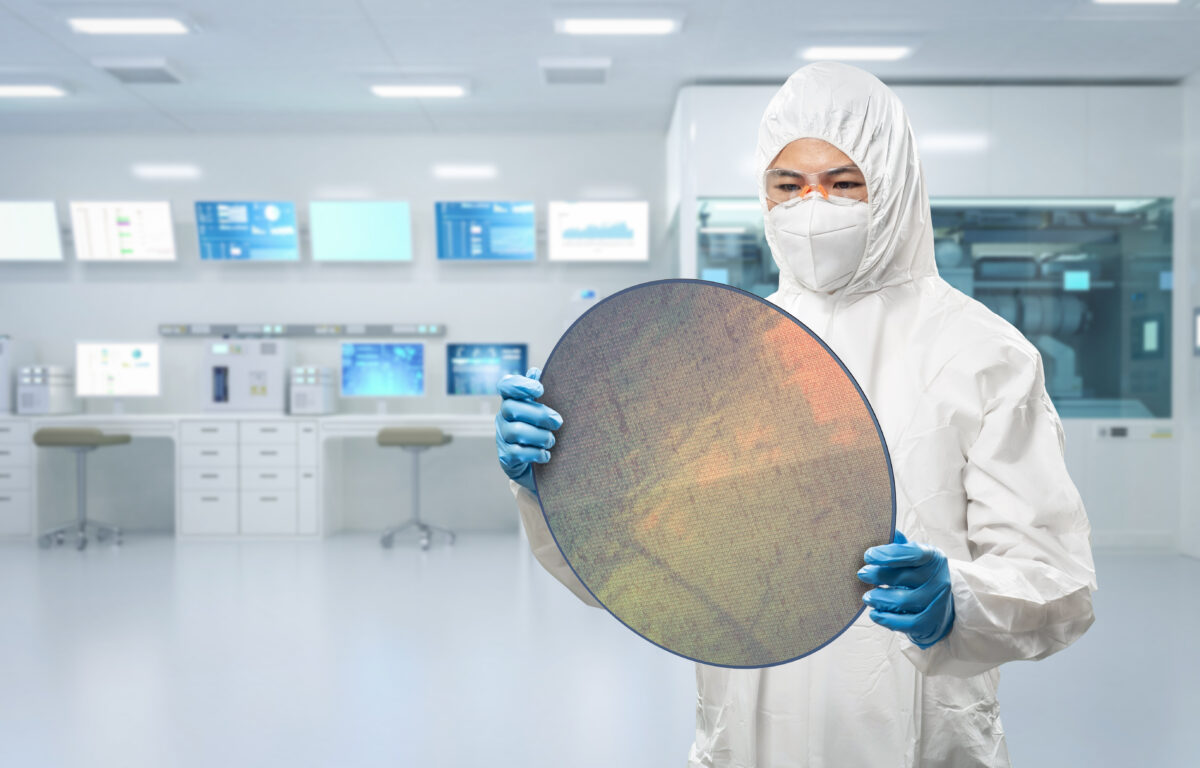

Picture supply: Getty Photos

Regardless of Nvidia’s robust affect on the present form of the GPU market, Taiwan Semiconductor’s diversified platform appears to be like higher positioned additional down the street, as extra {hardware} merchandise are launched. I consider TSMC as related to a long-term name possibility on the necessity for AI-powered chips. The corporate is able to profit, no matter which firm’s GPUs are witnessing probably the most demand.

Is Taiwan Semiconductor inventory a purchase proper now?

The chart beneath benchmarks TSMC inventory towards a peer set of different main semiconductor gamers on a forward price-to-earnings (P/E) foundation.

TSM PE Ratio (Forward) information by YCharts.

With a ahead P/E of 29.1, Taiwan Semiconductor is among the many least costly on this cohort. That is fairly attention-grabbing, contemplating that shares of Taiwan Semiconductor have surged by 112% over the previous 12 months. In different phrases, even with some appreciable valuation expansion in a short while body, Taiwan Semiconductor’s outlook would not appear to be fetching a commensurate a number of, in contrast to a few of its high-growth friends.

Coatue is making acceptable strikes because it relates to chip shares. The agency has locked in some positive factors by decreasing its Nvidia stake, but additionally stands to proceed benefiting from any upside, so long as it retains a place in some capability.

In the meantime, by persevering with to bolster its place in Taiwan Semiconductor, Coatue seems to be making a savvy transfer proper now. It may wind up being an much more profitable resolution because the AI narrative takes form over time.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Idiot recommends Broadcom and Intel and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief November 2024 $24 calls on Intel. The Motley Idiot has a disclosure policy.