Artificial intelligence (AI) has turned out to be a terrific catalyst for Oracle (NYSE: ORCL) in 2024, with shares of the cloud infrastructure and database software program supplier leaping 74% thus far this yr, as of this writing.

This spectacular rise in Oracle inventory is not stunning, as the corporate’s enterprise has acquired a giant increase due to the rising demand for its cloud infrastructure that is being rented by firms to prepare and deploy AI fashions. The great half is that the sturdy demand for cloud AI providers has allowed Oracle to construct a powerful income pipeline, which is anticipated to drive a pleasant acceleration within the firm’s development.

Are You Lacking The Morning Scoop? Get up with Breakfast information in your inbox each market day. (*1*)

Extra importantly, the marketplace for cloud-based AI providers that Oracle’s cloud infrastructure is serving is at present in its early phases of development. That is exactly the explanation why this AI inventory might find a way to maintain its spectacular development momentum in 2025, and past.

This is a take a look at the the reason why shopping for Oracle inventory appears like a no brainer.

Oracle’s AI-driven development potential factors towards a vivid future

Throughout Oracle’s fiscal 2025 first-quarter outcomes (ended Aug. 31) in September this yr, it reported an 8% year-over-year enhance in income to $13.3 billion. Extra importantly, the corporate mentioned it expects fiscal 2025 development to land in double digits on the again of strong development in cloud infrastructure income.

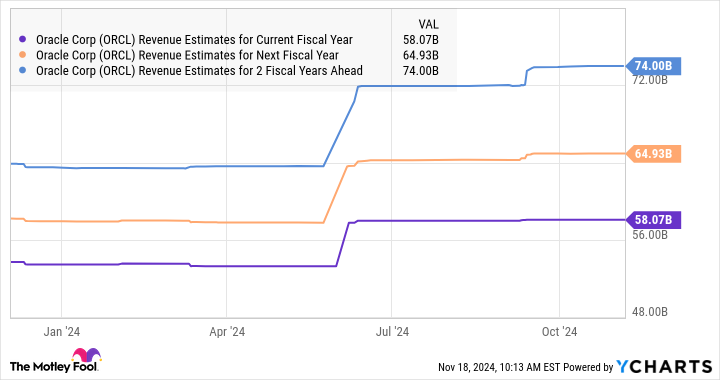

Oracle’s full-year steerage means that its income development is about to speed up over the 6% enchancment it witnessed in its prime line in fiscal 2024 to $53 billion. So the corporate’s income ought to ideally hit $58.3 billion this yr. The great half is that analysts expect Oracle’s income development to speed up over the following couple of fiscal years as nicely.

It will not be stunning to see the corporate certainly ship what Wall Avenue is in search of. That is as a result of the corporate began the primary quarter of fiscal 2025 with a 53% enhance in its remaining efficiency obligations (RPO) to $99 billion. For comparability, Oracle’s RPO elevated 44% within the fourth quarter of fiscal 2024.

The acceleration on this metric bodes nicely for Oracle, because the RPO refers to the longer term worth of an organization’s unfulfilled contracts. That determine might have been larger, however Oracle mentioned the demand for cloud infrastructure providers is outpacing provide. Not surprisingly, the corporate is trying to bring more capacity online, utilizing Nvidia‘s graphics processing items (GPUs) to construct big knowledge facilities to assist its prospects prepare giant AI fashions.

Oracle’s knowledge facilities at present serve 85 areas globally, and it has one other 77 which are both below building or are within the planning part. This aggressive enlargement ought to enable Oracle to meet the fast-growing demand for its cloud infrastructure. It’s price noting that its cloud-related RPO elevated by greater than 80% within the earlier quarter and represents three-fourths of its total RPO. There may be extra room for development on this area, given booming demand for cloud-based AI providers.

Oracle says that it witnessed a 162% year-over-year enhance in cloud-native AI prospects within the earlier quarter. The whole contract worth of its AI-specific offers in fiscal Q1 got here in at $3 billion. Goldman Sachs tasks that the cloud infrastructure-as-a-service (IaaS) market that Oracle serves may very well be price a whopping $580 billion in 2030, accounting for 29% of the general cloud spending of $2 trillion by the top of the last decade.

The funding financial institution provides that generative AI-based cloud spending might vary between $200 billion to $300 billion of the general market. Oracle is nicely on its approach to taking advantage of this multibillion-dollar alternative, with its cloud IaaS income leaping by 46% yr over yr in fiscal Q1 to $2.2 billion. In the meantime, the truth that it landed $3 billion price of AI-related cloud contracts throughout the identical quarter means that this enterprise is about for stronger development sooner or later.

So, it wasn’t stunning to see Oracle administration anticipating sooner development in cloud infrastructure income this fiscal yr, in contrast to the earlier interval. Extra importantly, the long-term alternative on this market is the explanation why Oracle raised its long-term development forecast, which could lead on to extra inventory upside in the long term.

The inventory’s valuation and long-term development potential make it price shopping for

Oracle expects to obtain $66 billion in income in fiscal 2026, which might be a 13% enhance over its fiscal 2025 projection. Moreover, it’s anticipating at the least 10% development in its earnings-per-share development subsequent yr. Nonetheless, in fiscal 2029, Oracle sees its prime line hitting at the least $104 billion. That will translate right into a three-year compound annual development charge of greater than 16% between fiscal 2026 and monetary 2029.

Contemplating that Oracle is now buying and selling at 29 instances ahead earnings, as in contrast to the tech-heavy Nasdaq-100 index’s ahead earnings a number of of 31.3, it is not too late for traders to purchase it. The sharp bounce in Oracle’s income development, together with the sooner enhance in its backside line, factors towards improved earnings energy in the long term, which ought to enable this cloud inventory to keep its wholesome inventory market momentum going ahead for an extended interval.

Do you have to make investments $1,000 in Oracle proper now?

Before you purchase inventory in Oracle, contemplate this:

The Motley Idiot Stock Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and Oracle wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $900,893!*

Stock Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 18, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Goldman Sachs Group, Nvidia, and Oracle. The Motley Idiot has a disclosure policy.

1 Unstoppable Artificial Intelligence (AI) Stock to Buy Before 2024 Ends was initially printed by The Motley Idiot