Cloudflare (NYSE: NET) operates the world’s main content material supply community (CDN) — a distributed cloud platform that places servers nearer to the place finish customers are, making knowledge switch quicker, safer, and extra dependable for its shoppers and their clients. With servers in 330 areas throughout the globe, its estimated share of the CDN market exceeds 42%.

As such, Cloudflare is in a strong place to profit from a possibility that is rising quickly. Know-how consulting agency SkyQuest estimates that the CDN market may clock annualized development of just about 22% between 2023 and 2031, producing $94 billion in income on the finish of the forecast interval as in comparison with simply over $19 billion final yr.

Certainly, Cloudflare has been rising at a strong tempo. The third-quarter outcomes it launched on Nov. 7 confirmed wholesome positive aspects in income and earnings. Extra importantly, it has been increasing into one other profitable area of interest — cloud-based artificial intelligence (AI) providers. That might grow to be a good transfer in the long term.

An enormous addressable market

Cloudflare’s income rose 28% yr over yr in Q3 to $430 million, whereas non-GAAP earnings elevated by 25%. The highest line exceeded Wall Road’s consensus expectation of $424 million.

Nevertheless, administration stated it anticipates $451.5 million in income within the present quarter on the midpoint of its steerage vary, together with $0.18 per share in earnings. Analysts had been wanting for $0.17 per share in earnings on income of $455.7 million. That less-than-impressive steerage helps clarify why Cloudflare inventory fell by greater than 4% following the report’s launch.

Cloudflare did elevate its full-year steerage. It now expects 2024 income to land at $1.661 billion as in comparison with the sooner estimate of $1.658 billion. Its earnings estimate was additionally boosted to $0.74 per share from an earlier vary of $0.70 per share to $0.71 per share. The up to date steerage would quantity to a income leap of 28% and spectacular bottom-line development of 51%.

Nonetheless, merchants determined to press the promote button — maybe partially resulting from Cloudflare administration’s assertion that the corporate’s clients stay cautious about spending. As CEO Matthew Prince stated on the earnings conference call:

In Q3, the IT spending atmosphere remained per prior quarters, with clients intently scrutinizing each deal, emphasizing value effectivity and in search of significant ROI. This cautious strategy is not new. It is one thing we perceive, and as a should have, not a good to have, profit from relative to a few of our friends.

Nevertheless, Cloudflare nonetheless delivered wholesome development regardless of the difficult atmosphere. Extra importantly, it expanded its buyer base and continues to win rising shares of its clients’ wallets. Cloudflare’s paying buyer base elevated by 22% yr over yr final quarter to simply over 221,500. Even higher, the variety of clients producing greater than $100,000 in annualized income for the corporate grew by almost 28%.

Furthermore, present clients continued to extend their spending: Cloudflare’s dollar-based internet retention price was 110%. This metric compares the annualized income from its clients within the newest quarter to the annualized income from the identical buyer cohort within the year-ago interval. Clearly, established clients are shopping for further merchandise or are extending their utilization of the platform.

Cloudflare estimates that its complete addressable market may develop from $176 billion this yr to $222 billion in 2027, pushed by incremental development alternatives in areas corresponding to AI. This explains why the corporate has been investing in AI-specific {hardware} corresponding to high-end graphics processing models (GPUs) to energy its AI choices.

In September 2023, Cloudflare introduced an AI-specific suite of merchandise that included Staff AI, a platform that permits clients to run AI fashions on Cloudflare’s community, powered by GPUs from the likes of Nvidia. Staff AI is already gaining wholesome traction amongst customers — the corporate has landed a number of offers operating into the hundreds of thousands of {dollars} for it.

It will not be shocking to see Cloudflare’s cloud-based AI choices achieve extra traction because it makes its AI-related choices accessible throughout almost all of the cities that it serves. It was already accessible in 150 cities as of April this yr, and it is effectively on its approach to its purpose of deploying AI GPUs in 300 cities by the tip of 2024.

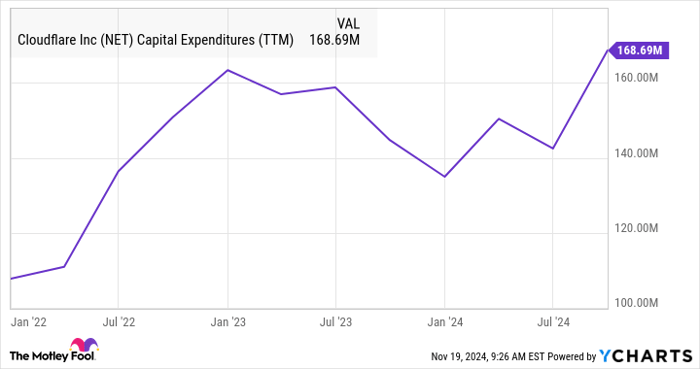

Naturally, Cloudflare has been growing its capital bills because it buys and deploys these GPUs.

NET Capital Expenditures (TTM) knowledge by YCharts.

This appears to be like like a good transfer from a long-term perspective, as Mordor Intelligence estimates that the dimensions of the cloud-based AI providers market will enhance at an annualized price of 32% by way of 2029 to $274 billion. Furthermore, Cloudflare already has a massive base of shoppers to whom it could actually cross-sell its AI-focused choices. As a consequence, it will not be shocking to see the corporate’s development speed up in the long term because of AI.

The valuation is wealthy, however there’s a silver lining

Although Cloudflare has been clocking wholesome development, it trades at an costly 19 occasions gross sales proper now. That is considerably greater than the S&P 500 index’s price-to-sales ratio of simply over 3. Equally, Cloudflare’s ahead earnings a number of of 107 can be lofty in comparison with the S&P 500 index’s ahead earnings a number of of 24.6.

So traders wanting for tech shares that are not too costly will most likely think about different methods to capitalize on the AI growth. Nevertheless, growth-oriented traders ought to notice that Cloudflare’s income pipeline is increasing at a formidable tempo. Its remaining efficiency obligations (RPO) jumped 39% yr over yr in Q3, considerably outpacing its income development.

As RPO refers back to the worth of a firm’s contracts that can be fulfilled sooner or later, the terrific development on this metric means that Cloudflare’s prime line ought to develop at a quicker tempo sooner or later. This is why traders with a tolerance for danger can nonetheless think about shopping for Cloudflare, as its dive into AI appears set to unlock a terrific long-term development alternative that might ship its inventory hovering.

Don’t miss this second likelihood at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definitely’ll wish to hear this.

On uncommon events, our knowledgeable staff of analysts points a “Double Down” stock advice for firms that they assume are about to pop. When you’re anxious you’ve already missed your likelihood to take a position, now’s the very best time to purchase earlier than it’s too late. And the numbers converse for themselves:

-

Nvidia: if you happen to invested $1,000 after we doubled down in 2009, you’d have $378,269!*

-

Apple: if you happen to invested $1,000 after we doubled down in 2008, you’d have $43,369!*

-

Netflix: if you happen to invested $1,000 after we doubled down in 2004, you’d have $476,653!*

Right now, we’re issuing “Double Down” alerts for three unbelievable firms, and there is probably not one other likelihood like this anytime quickly.

*Stock Advisor returns as of November 18, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Cloudflare and Nvidia. The Motley Idiot has a disclosure policy.