Artificial intelligence (AI) is the most revolutionary know-how in a era. Its capacity to immediately generate textual content, pictures, movies, and even pc code might drive a productiveness increase for companies throughout the world.

The business remains to be in its infancy, however Wall Street’s forecasts recommend AI might add anyplace between $7 trillion and $200 trillion to the international economic system throughout the subsequent decade. That is why know-how giants are battling each other for AI supremacy and spending astronomical quantities of cash on information middle infrastructure and chips.

The place to make investments $1,000 proper now? Our analyst staff simply revealed what they imagine are the 10 finest shares to purchase proper now. (*1*)

According to an estimate from funding financial institution Morgan Stanley, 4 know-how giants alone might make investments a mixed $300 billion in capital expenditures (capex) in 2025. Driving that spending might be AI, and with Nvidia (NASDAQ: NVDA) supplying the most superior chips in the business for AI growth, its inventory is also the greatest winner from the spending increase.

Here is how a lot tech giants are presently spending

So as to make “smarter” AI software program, builders want to prepare extra refined large language models (LLMs). That requires extra information and likewise extra processing energy, which is the costly half.

Outdoors of cashed-up AI start-ups like OpenAI and Anthropic, most companies cannot afford to construct their very own information facilities. As an alternative, they lease computing capability from tech giants which can be constructing centralized infrastructure.

Primarily based on public filings, here is how a lot a few of these tech behemoths are allocating to capex, together with AI infrastructure:

Chips are a large element of that spending. Throughout 2023, Nvidia’s H100 graphics processing items (GPUs) had been the go-to selection for AI growth, granting the firm a market share of 98%. They continue to be a sizzling vendor at present, however Nvidia simply began delivery its new Blackwell GPUs, which provide a substantial leap in efficiency.

Picture supply: Getty Pictures.

Morgan Stanley’s forecast factors to loads of progress in 2025

Morgan Stanley expects 4 tech giants to spend a mixed $300 billion on capex in 2025. Primarily based on its forecast:

- Amazon might spend $96.4 billion

- Microsoft might spend $89.9 billion

- Alphabet might spend $62.6 billion

- Meta Platforms might spend $52.3 billion

These figures symbolize materials progress from what these corporations are on monitor to spend in 2024. It is not possible to know the way a lot of that cash will go towards chips, particularly. However Morgan Stanley issued a forecast again in October that means Nvidia might ship up to 800,000 items of its Blackwell-based GB200 GPU throughout the first three months of 2025 alone.

Worth estimates vary between $60,000 and $100,000 per GB200 GPU (in accordance to Forbes), so these gross sales might translate into $64 billion of income throughout the first quarter of 2025 (based mostly on a median worth of $80,000 per GPU).

Since Nvidia generated $35 billion in complete income in its most up-to-date quarter, that means vital progress could possibly be round the nook.

Experiences recommend Microsoft is already the greatest purchaser of GB200 GPUs, and Nvidia says Oracle plans to build a cluster utilizing over 131,000 of them. The GB200 NVL72 system can carry out AI inference at 30 instances the pace of the equal H100 system, so it is no shock there’s a line of patrons that stretches round the block.

Nvidia inventory could possibly be the greatest beneficiary of the spending increase

Now, let’s discuss what all of that spending might imply for Nvidia stock as a result of regardless of its 700% achieve over the final two years, it’d truly nonetheless be low-cost.

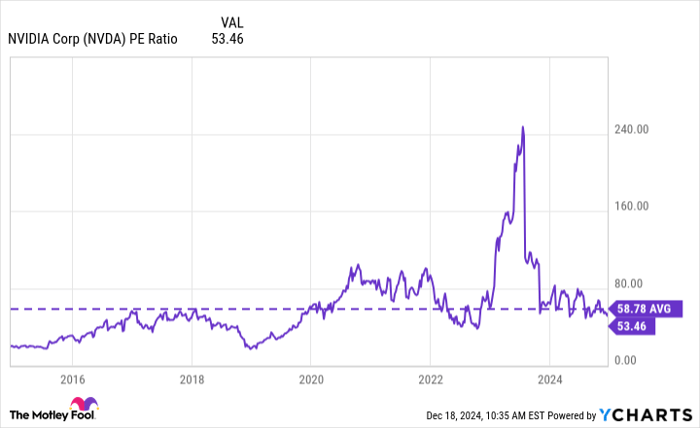

Nvidia is on monitor to generate $129 billion in income throughout its fiscal 2025 (which ends in January), however it’s additionally extremely worthwhile. The corporate has delivered $2.54 in earnings per share (EPS) over the final 4 quarters, giving it a price-to-earnings (P/E) ratio of 53.5 as of this writing. That is under its 10-year common of 58.8:

Information by YCharts.

Nevertheless, the image will get even higher whenever you look into the future. Primarily based on Wall Street’s consensus forecast for Nvidia’s fiscal 12 months 2026 (which begins in Feb. 2025), the firm might generate $4.43 in EPS on $195 billion in income.

Which means Nvidia inventory trades at a forward P/E ratio of simply 30.6. In different phrases, the inventory would have to soar over 90% all through subsequent 12 months simply to commerce in line with its 10-year common P/E ratio of 58.8.

And there may even be additional upside potential based mostly on the truth Nvidia has persistently overwhelmed Wall Street’s expectations.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Stock Advisor analyst staff simply recognized what they imagine are the (*4*) for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize might produce monster returns in the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 at the time of our suggestion, you’d have $825,513!*

Stock Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Idiot recommends the following choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.