This previous 12 months was one other terrific one for know-how shares in specific. Tailwinds pushed by synthetic intelligence (AI) helped push the S&P 500 greater by 23%, whereas the Nasdaq Composite gained a powerful 29%.

The “Magnificent Seven” shares had been among the many 12 months’s high gainers in the market, and maybe no different garnered extra consideration than semiconductor chief Nvidia — which was the top-performing inventory in the Dow Jones Industrial Common in 2024.

Last 12 months, Nvidia gained roughly $2.1 trillion in market capitalization — the very best of any firm. This propelled Nvidia to develop into one of many world’s Most worthy companies. Whereas Nvidia’s present run might counsel that the inventory is due for a pullback, Wedbush Securities know-how analyst Dan Ives is looking for considerably extra progress forward for the AI darling — and I agree.

Let’s take a look at Nvidia’s newest catalysts and make the case for why 2025 might be one other one for the document books.

Over the past two years, Nvidia has emerged because the chief of the pack in the AI marathon, and all of it boils down to 1 factor: graphics processing items (GPUs). GPUs are superior chipsets essential for growing generative AI functions.

Nvidia’s deep roster of GPUs has helped the corporate separate from opponents resembling Superior Micro Units, and purchase an estimated 90% of the GPU market.

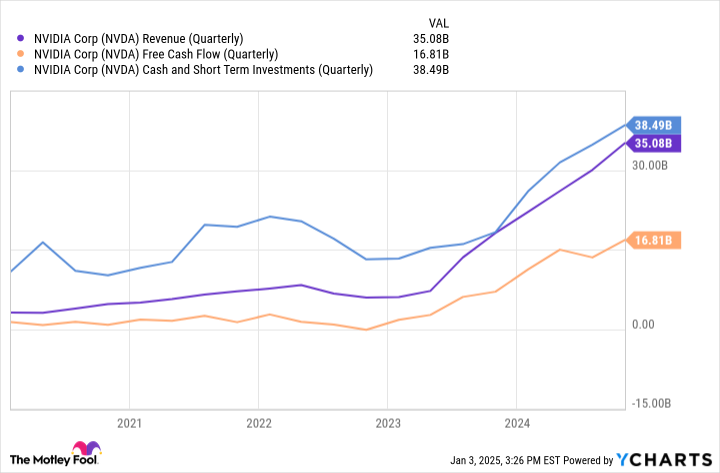

So as to add some context right here, Nvidia’s dominance has fueled constant income and revenue progress for the corporate — permitting it to double down on analysis and improvement (R&D) and pioneer even newer, revolutionary merchandise. Enter Blackwell, Nvidia’s next-generation GPU structure, which is reportedly already offered out for the following 12 months.

Whereas that is extra of a company-specific tailwind, Ives believes that broader investments in AI infrastructure might eclipse $1 trillion in the approaching years. Nvidia is profiting from this windfall of rising capital expenditure (capex), underscored by investments in European GPU cluster specialist Nebius, and the acquisition of AI infrastructure enterprise Run:ai (which it acquired for a reported $700 million).

Given the huge rise in Nvidia’s inventory value, it is a prudent thought to have a look at a few of the firm’s valuation metrics and cross-reference them in opposition to the catalysts I’ve coated above.

|

Valuation Metric |

Value as of Jan. 3 |

|---|---|

|

Value-to-earnings (P/E) ratio |

56.7 |

|

Ahead P/E ratio |

48.8 |

|

Value-to-free money move (P/FCF) |

63.4 |

|

Value/earnings-to-growth (PEG) ratio |

1.0 |

Knowledge supply: YCharts.