Many synthetic intelligence (AI) shares have generated incredible good points for traders over the previous couple of years. Even should you did not make investments early in this development, you continue to may have made good returns final 12 months by investing in some high performing AI shares.

The place to speculate $1,000 proper now? Our analyst group simply revealed what they consider are the 10 greatest shares to purchase proper now. See the 10 stocks »

As an illustration, Palantir Applied sciences (NASDAQ: PLTR), SoundHound AI (NASDAQ: SOUN), and Nvidia (NASDAQ: NVDA) all proved to be super investments in 2024. Should you had invested $7,000 into every of these shares at the begin of final 12 months, you’d have a portfolio value greater than $120,000 by the finish of the 12 months, a close to five-fold enhance in pre-tax wealth. This is a have a look at how properly every of these shares did, and whether or not or not it is too late to speculate in them immediately.

Palantir Applied sciences

Knowledge analytics specialist Palantir Applied sciences has been leveraging AI to reinforce its services. It is a massive title in counterterrorism and intelligence, with governments shoppers round the world. It has additionally been experiencing a lot of progress on the industrial aspect, growing options that may assist a big selection of companies make higher choices.

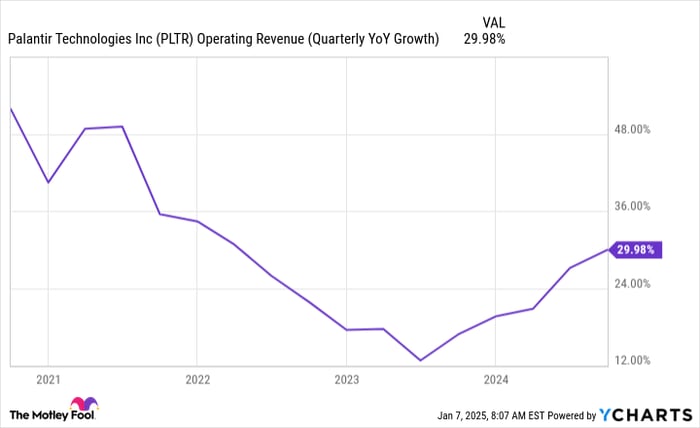

The corporate has held a whole lot of boot camps to introduce potential prospects to the Palantir Artificial Intelligence Platform (AIP) and assist these companies perceive the use circumstances for that software program. The outcomes have been terrific. CEO Alex Karp has described the ensuing demand for AIP as “unrelenting,” and gross sales persevering with to speed up. Whereas Palantir’s progress fee was declining in latest years, the tide turned in 2024.

PLTR Operating Revenue (Quarterly YoY Growth) knowledge by YCharts.

Now, with Palantir constantly worthwhile and a newly minted S&P 500 part, traders stay extraordinarily bullish about the inventory. An funding of $7,000 into the enterprise a 12 months in the past can be value greater than $33,000 by the finish of 2024.

The hazard in shopping for or holding this AI stock immediately, nonetheless, is that it trades at round 118 instances subsequent 12 months’s anticipated earnings — a huge premium. Until you are extremely bullish on the inventory and are comfy with the threat of a attainable correction this 12 months, you might need to contemplate cashing out. I might be shocked for the inventory to supply up a repeat efficiency in 2025.

SoundHound AI

The smallest firm on this listing is voice AI specialist SoundHound AI, which has a market cap of round $5.5 billion. Late final 12 months, its inventory worth took off after the firm delivered robust quarterly outcomes and saved rising because it introduced offers with a number of restaurant chains.

In early December, it stated that Torchy’s Tacos, a widespread regional taco chain, had rolled out the firm’s AI Sensible Ordering service in any respect of its 130 areas. Later that month, it additionally introduced that Church’s Texas Hen would give its prospects the choice to make use of SoundHound’s AI in drive-thrus to assist expedite the ordering course of.

On condition that SoundHound’s enterprise that’s nonetheless in the early phases of progress and that it faces a lot of competitors, information of extra corporations adopting its expertise can have a actual impression for its enterprise and, in flip, improve the market’s confidence that this can be the actual deal. The enterprise is not worthwhile but, however SoundHound reported 89% income progress in the third quarter to $25.1 million. Its internet loss grew by 8% to $21.8 million, however traders look like prepared to be affected person with the enterprise given its enticing progress alternatives in not simply the fast-food trade however in the automotive sector and different areas.

Pushed by SoundHound inventory’s robust rally towards the finish of final 12 months, a $7,000 funding in its shares a 12 months in the past would’ve been value almost $70,000 b the finish of 2024. However as with Palantir, I might be involved that SoundHound’s valuation has turn into a bit too wealthy, so it could not be capable to do almost as properly this 12 months. The primary week of 2025 has been risky for this inventory, nevertheless it’s too early to evaluate the place the inventory may be headed. Presently, the inventory trades at 68 instances its trailing-12-month revenue.

Nvidia

Nvidia’s presence on any listing of 2024’s nice AI shares ought to shock nobody. The chipmaker has been offering the processing energy for a lot of AI-powered initiatives with its cutting-edge graphics processing models (GPUs). With a market cap now in extra of $3 trillion, Nvidia is one of the Most worthy corporations in the world, and has been a high growth stock to purchase and maintain in latest years.

What’s actually spectacular about Nvidia is that it continues to put up spectacular top- and bottom-line progress. Throughout the nine-month interval ending Oct. 27, its income totaled $91.2 billion — a 135% enhance from the identical interval final 12 months. And it achieved that whereas sustaining an exceptionally excessive revenue margin of 56% as its backside line soared from $17.5 billion to $50.8 billion.

To simply develop income is one factor, however Nvidia’s earnings are additionally taking off. That is why of these three corporations, it is the most fairly valued one and the funding which can nonetheless have extra near-term upside. it is buying and selling at 35 instances subsequent 12 months’s estimated earnings and its price-to-earnings growth ratio is true round 1, signifying that it is a good worth for long-term traders.

Should you invested $7,000 into Nvidia’s inventory a 12 months in the past, your shares would’ve been value over $19,000 at the finish of 2024. Mixed with the different shares on this listing, $7,000 invested throughout all these corporations would have created a portfolio value roughly $122,000 coming into the new 12 months.

Don’t miss this second probability at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for the most profitable shares? Then you definately’ll need to hear this.

On uncommon events, our professional group of analysts points a (*3*) advice for corporations that they assume are about to pop. Should you’re frightened you’ve already missed your probability to speculate, now’s the greatest time to purchase earlier than it’s too late. And the numbers converse for themselves:

-

Nvidia: should you invested $1,000 once we doubled down in 2009, you’d have $363,385!*

-

Apple: should you invested $1,000 once we doubled down in 2008, you’d have $45,870!*

-

Netflix: should you invested $1,000 once we doubled down in 2004, you’d have $474,140!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of January 6, 2025

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a disclosure policy.