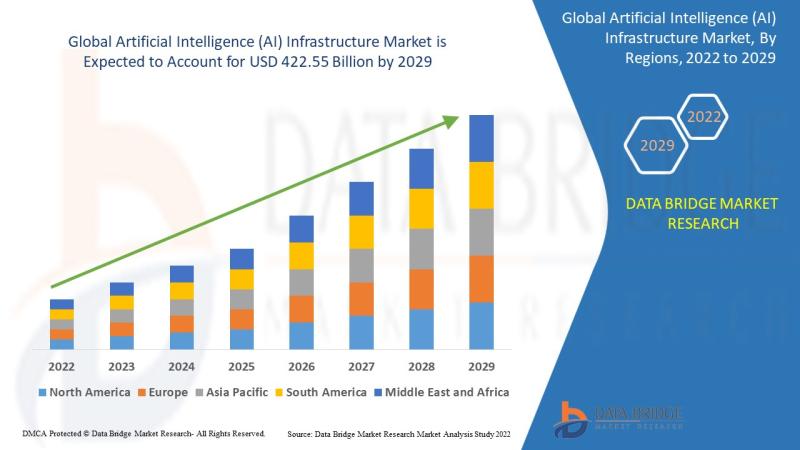

Artificial Intelligence (AI) Infrastructure Market was valued at USD 23.50 billion in 2021 and is predicted to attain USD 422.55 billion by 2029, registering a CAGR of 43.50% in the course of the forecast interval of 2022-2029. Cloud account for the most important deployment kind section within the respective market owing to the rise within the variety of information heart suppliers and cloud corporations.

Market Definition:

An Artificial Intelligence (AI) infrastructure refers to the expertise that assists with machine studying (ML). The expertise signifies the mix of machine studying and synthetic intelligence options for improvement and deployment of scalable, dependable and particular information options. AI Infrastructure is thought to key allow the entire machine studying course of from begin to end.

Browse Extra About This Analysis Report @ https://www.databridgemarketresearch.com/experiences/global-ai-infrastructure-market

Cisco (US), IBM (US), Intel Company (US), SAMSUNG (South Korea), Google (US), Microsoft (US), Micron Expertise, Inc (US), NVIDIA Company (US), Oracle (US), Arm Restricted (UK), Xilinx (US), Superior Micro Gadgets, Inc (US), Dell (US), Hewlett Packard Enterprises Improvement LP (US), Habana Labs Ltd (US), Fb, Inc (US), Synopsys, Inc (US), Nutanix (US), Pure Storage, Inc (US), Amazon Net Providers, Inc (US), amongst others

Aggressive Panorama and Artificial Intelligence (AI) Infrastructure Market:

The unreal intelligence (AI) infrastructure market aggressive panorama gives particulars by competitor. Particulars included are firm overview, firm financials, income generated, market potential, funding in analysis and improvement, new market initiatives, world presence, manufacturing websites and services, manufacturing capacities, firm strengths and weaknesses, product launch, product width and breadth, utility dominance. The above information factors supplied are solely associated to the businesses’ focus associated to synthetic intelligence (AI) infrastructure market.

Browse Extra Stories:

https://databridgenews.blogspot.com/2024/09/taste-modulators-market-with-growing.html

https://databridgenews.blogspot.com/2024/09/free-to-air-fta-service-market-is.html

https://databridgenews.blogspot.com/2024/09/benefits-of-circuit-breaker-and-fuses.html

https://databridgenews.blogspot.com/2024/09/what-are-insight-engines-research.html

About Information Bridge Market Analysis:

An absolute approach to predict what the long run holds is to perceive the present pattern! Information Bridge Market Analysis offered itself as an unconventional and neoteric market analysis and consulting agency with an unparalleled degree of resilience and built-in approaches. We’re dedicated to uncovering one of the best market alternatives and nurturing efficient data for your corporation to thrive within the market. Information Bridge strives to present applicable options to advanced enterprise challenges and initiates an easy decision-making course of. Information Bridge is a set of pure knowledge and expertise that was formulated and framed in 2015 in Pune.

Contact Us: –

Information Bridge Market Analysis

E-mail: – sopan.gedam@databridgemarketresearch.com

This launch was printed on openPR.