Nvidia (NASDAQ: NVDA) and SoundHound AI (NASDAQ: SOUN) have set the inventory market on fireplace this 12 months with gorgeous good points to date, although a better take a look at the trajectory of the shares of those two corporations exhibits us that their spikes might be attributed to totally different causes.

Nvidia’s 90% good points in 2024 are a results of the corporate’s excellent top- and bottom-line progress, pushed by the new demand for its graphics processing items (GPUs) and processors for powering artificial intelligence (AI) servers.

SoundHound AI, alternatively, sprang into the limelight in February this 12 months when it was revealed that Nvidia holds a stake within the firm. SoundHound inventory subsequently jumped a shocking 347% in February.

SoundHound AI has been delivering healthy growth due to the rising deployment of its AI voice-recognition know-how throughout a number of industries, together with automaking and eating places. However the Nvidia funding introduced the inventory below higher scrutiny, and a weaker-than-expected earnings report for the fourth quarter of 2023 despatched its shares packing in March.

So, although SoundHound shares are up 158% in 2024, they’re down greater than 38% from mid-March. However is that this pullback a chance for buyers to purchase the inventory? Or ought to they like Nvidia to revenue from the AI growth? Let’s discover out.

The case for SoundHound AI

Could has turned out to be a terrific month for SoundHound AI because the inventory appears to have regained its mojo.

First-quarter 2024 outcomes, which have been launched on Could 9, have boosted investor confidence as soon as once more. The inventory shot up due to a 73% year-over-year improve in income to $11.6 million.

The adjusted internet loss was down by a penny to $0.07 per share. SoundHound elevated the midpoint of its 2024 income steerage to $71 million from the sooner estimate of $70 million.

The up to date income steerage would translate right into a 55% year-over-year improve. For comparability, SoundHound’s high line elevated 47% in 2023, which signifies that the corporate’s progress is ready to speed up this 12 months. And administration expects to exceed $100 million in income in 2025, that means that it goals to ship 40%-plus income progress subsequent 12 months as nicely.

The rationale SoundHound is so assured sooner or later is due to an bettering potential income pipeline and partnerships with large gamers equivalent to Nvidia and the automaker Stellantis. In March this 12 months, the corporate stated that its generative AI voice assistant, SoundHound Chat AI, is on Nvidia’s Drive automotive platform. And Stellantis has already began integrating SoundHound AI’s voice-recognition help into its automobiles.

Fast-service eating places have been adopting this know-how as nicely for taking meals orders. In all, SoundHound sees a complete addressable market price $140 billion for voice-recognition AI throughout a number of finish markets, so there’s a good likelihood it might proceed to develop at a wholesome tempo in the long term and stay a high AI inventory.

The case for Nvidia

With an estimated 98% share of the marketplace for information heart GPUs, Nvidia provides buyers a terrific option to capitalize on the booming demand for AI infrastructure. Coaching massive language fashions and deploying know-how that SoundHound and others are providing would not have been attainable with out the computational energy of Nvidia’s chips.

Nvidia enjoys a technological benefit over rival chipmakers making an attempt to enter the AI chip market, and the corporate is predicted to keep up its dominance with the launch of latest chips later this 12 months. That is why Nvidia is predicted to continue to grow sooner than SoundHound.

Income in fiscal 2024 (which led to January this 12 months) was up 126% 12 months over 12 months to $60.9 billion, nicely forward of the expansion that SoundHound AI delivered final 12 months.

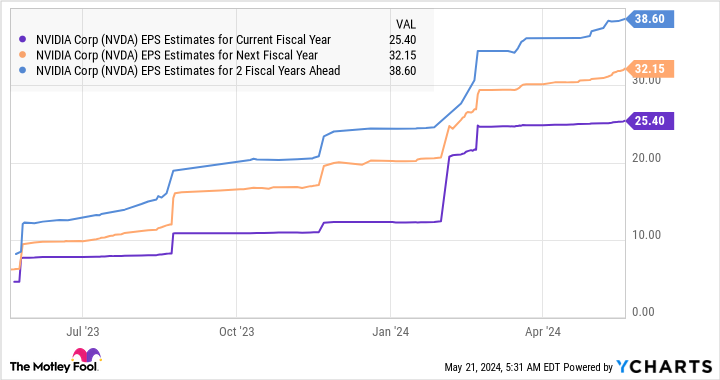

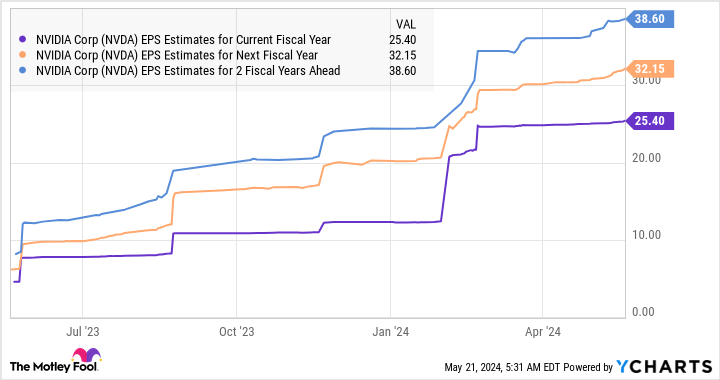

Nvidia’s adjusted earnings jumped 288% 12 months over 12 months to $12.96 per share. SoundHound reported a lack of $0.40 per share for 2023 and is not anticipated to show worthwhile any time quickly. Nvidia’s earnings are anticipated to maintain heading greater over the following couple of years.

Nvidia’s stronger earnings energy, its spectacular market share, and the AI chip market — which is predicted to develop 38% yearly by 2032 and generate $372 billion in annual income — point out that it may well maintain its wholesome progress for a very long time. In the meantime, SoundHound AI is predicted to run into competitors from well-heeled tech giants in addition to the likes of OpenAI.

Potential SoundHound buyers ought to be aware that it’s a very small firm proper now, whereas Nvidia is a longtime company with a large moat in AI chips. That is why the latter appears just like the safer AI play proper now, particularly contemplating the valuation of the 2 shares.

The decision

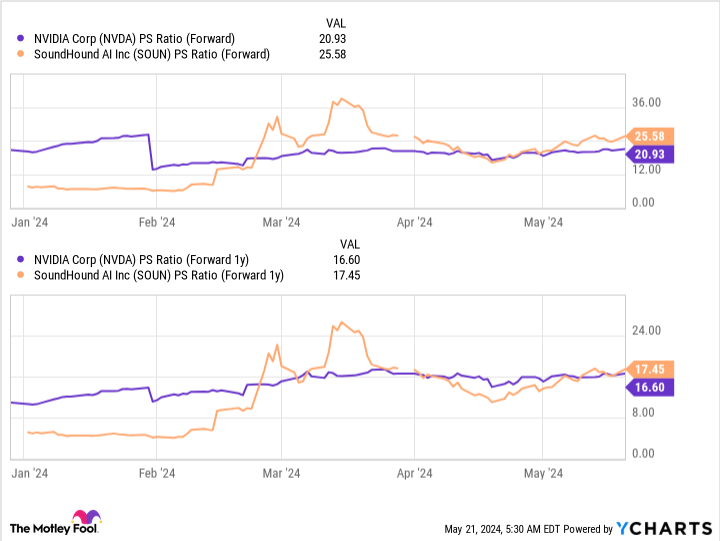

Nvidia’s price-to-sales (P/S) ratio of 39 makes the inventory dearer than SoundHound’s shares, which commerce at 27 occasions gross sales. The chipmaker’s richer valuation is justified contemplating its sooner progress, fast-improving backside line, and near-monopoly in AI chips, so it is the cheaper of the 2 if we check out their ahead gross sales multiples.

All this means that Nvidia is the higher AI inventory to purchase, and buyers ought to have a straightforward selection contemplating the factors mentioned above. Nvidia’s greater price-to-sales ratio is justified by its sooner progress and powerful market place in AI chips. Thus, regardless of its greater valuation, Nvidia seems to be the safer and extra promising AI funding.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $652,342!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 13, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot recommends Stellantis. The Motley Idiot has a disclosure policy.

Better Artificial Intelligence Stock: Nvidia vs. SoundHound AI was initially printed by The Motley Idiot

Dynamic Technology Lab Private Ltd acquired a brand new stake in Booz Allen Hamilton Holding Co. (

Dynamic Technology Lab Private Ltd acquired a brand new stake in Booz Allen Hamilton Holding Co. (

Robeco Institutional Asset Management B.V. lowered its stake in shares of Align Expertise, Inc. (

Robeco Institutional Asset Management B.V. lowered its stake in shares of Align Expertise, Inc. (