Many buyers search small-cap shares with the potential to dominate their area of interest, as their small dimension prevents them from being considerably owned by massive companies. Moreover, due to their small dimension, buyers will massively profit in the event that they see vital progress becasue they began from a small place to begin.

Mix small-cap potential with an explosive business like synthetic intelligence (AI), and you’ve got a recipe for an funding that might be unbelievably worthwhile. One pretty well-liked AI inventory is SoundHound AI (NASDAQ: SOUN). At a current $1.8 billion valuation, it is barely under the historic “small cap” threshold of $2 billion.

Nevertheless, one benefit of investing in small caps is that the shares are comparatively unknown. SoundHound is already fairly well-liked, however does that depart room for upside?

SoundHound’s know-how is discovering adoption in two industries

SoundHound AI does precisely what its title suggests it does. It offers AI options for any product that offers with sound. SoundHound’s merchandise have excelled in two niches: eating places and automotive.

The restaurant business is working to automate drive-thru and cellphone ordering so eating places need not employees folks to do these jobs. This has enormous value financial savings potential for eating places. Corporations like Jersey Mike’s Subs and White Fort are implementing these applied sciences, and so they’re changing into more and more mainstream.

One other space the place SoundHound’s merchandise are being deployed is automotive. For years, digital assistants in autos have not been very helpful and are a characteristic few folks use. Nevertheless, with SoundHound’s know-how, they’ve develop into extra responsive and are even being built-in with massive language fashions, like ChatGPT, in international locations like Japan.

One concern with this know-how is that it requires connectivity to the web, which is not all the time obtainable throughout journey. As a outcome, Nvidia partnered with SoundHound to implement its know-how on its vehicle-specific GPU in order that this is not a problem.

This partnership additionally precipitated a frenzy with SoundHound’s inventory, as Nvidia owns round 1.73 million shares of SoundHound. If probably the greatest AI investments owns a chunk of one other AI firm, the market is more likely to take discover.

With SoundHound not an unknown small-cap inventory, is it nonetheless price a purchase?

SoundHound is not a surefire funding

SoundHound has been rising at a wholesome tempo, with its This autumn income coming in at $17.1 million, indicating 80% year-over-year progress. Nevertheless, what buyers are most enthusiastic about is SoundHound’s backlog. Its income backlog grew to a whopping $661 million, indicating it has a large quantity of enterprise within the pipeline.

Nevertheless, this is not assured income, as there is no telling when it is going to be acknowledged.

Moreover, the AI area is filled with competitors. It would not take a lot for an AI large like Alphabet or Microsoft to activity a small chunk of its firm to develop a resolution rivaling SoundHound’s and sure drive it out of enterprise. For instance, OpenAI (partnered with Microsoft) already has the know-how to do real-time translation. If it will probably carry out that, then it will probably seemingly perceive somebody ordering at a restaurant or asking a digital assistant in a automobile.

Moreover, SoundHound’s enterprise is way from worthwhile. The corporate posted an working lack of $12.4 million, or about a 73% loss margin. Losses like that may’t go on perpetually, particularly when there’s solely $100 million within the financial institution.

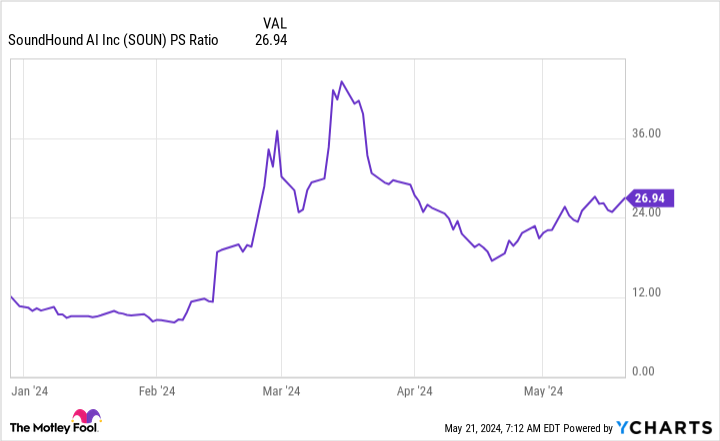

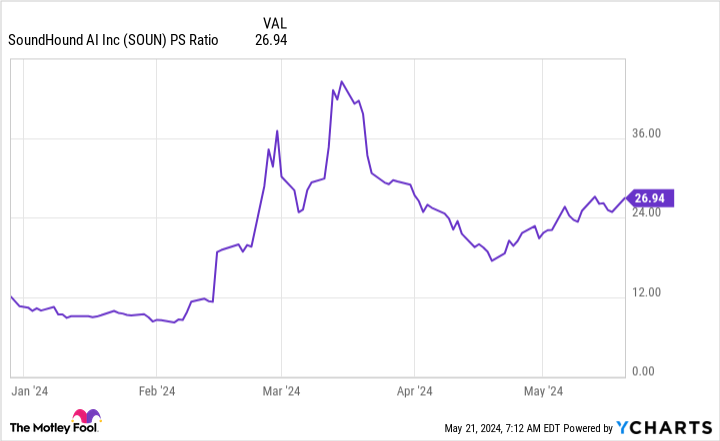

Lastly, whereas many small-cap shares fly underneath the radar, giving them enticing valuations, SoundHound’s inventory is sort of costly.

At 27 times sales, the inventory already has a good bit of success baked into the value.

As a outcome, I believe I will go on SoundHound’s inventory for now. However should you’re nonetheless , contemplate this funding extra like a lottery ticket. It could work out or not, so your expectations must be set accordingly. This funding may go to zero if an AI large like Alphabet or Microsoft decides to enter this field.

Do you have to make investments $1,000 in SoundHound AI proper now?

Before you purchase inventory in SoundHound AI, contemplate this:

The Motley Idiot Stock Advisor analyst crew simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and SoundHound AI wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $652,342!*

Stock Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

(*1*)

*Stock Advisor returns as of Might 13, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure policy.

1 Small-Cap Artificial Intelligence (AI) Stock That Could Be a Monster Winner was initially printed by The Motley Idiot