The S&P 500 and Nasdaq Composite have each posted returns of roughly 10% thus far in 2024. One of many largest catalysts driving these returns is artificial intelligence (AI).

Whereas this would possibly make the expertise sector significantly tempting, good buyers know that not all alternatives are equal.

One inventory that acquired forward of itself amid AI euphoria is UiPath (NYSE: PATH), a developer of robotics processing automation (RPA) software program to assist workplace employees with administrative duties. Originally of the yr, shares of UiPath have been hovering round $25. However now? The inventory is down over 50% this yr, and shares commerce for simply $11.

Let’s discover what is going on on at UiPath, and I am going to make the case for why the corporate shall be acquired inside the subsequent yr.

What is going on on at UiPath?

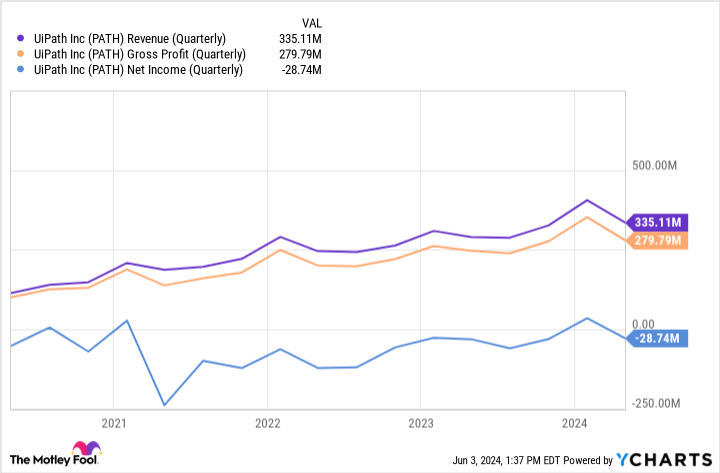

The chart beneath illustrates some necessary monetary metrics for UiPath over the past 5 years. On the floor, there are two lowlights.

First, progress in UiPath’s income and gross revenue are decelerating. Second, this dynamic compounds and is taking a toll on the corporate’s profitability — or lack thereof.

For its first quarter of fiscal 2025, ended April 30, UiPath solely added $44 million of web new annual recurring income (ARR). By comparability, in the course of the firm’s fiscal yr 2024 (ended Jan. 31), UiPath added $260 million in web new ARR — implying a median of $65 million per quarter.

The place will UiPath go subsequent?

At a excessive stage, enterprise software program gross sales have cooled over the past couple of years. Cussed inflation ranges and a rising-interest-rate surroundings have triggered companies of all sizes to rein in spending and function beneath leaner budgets.

Whereas I perceive these dynamics, I feel pointing to a difficult macroeconomic image solely works for thus lengthy. Throughout UiPath’s earnings call, buyers realized that gross sales cycles have change into extended as potential prospects aren’t precisely champing on the bit to purchase the corporate’s instruments.

One other surprising element revealed throughout UiPath’s earnings name was that CEO Rob Enslin resigned and is being changed by the corporate’s co-founder, Daniel Dines.

Who could be all for buying UiPath?

Whereas Dines might very effectively ignite some newfound power into the corporate, I believe that the board of administrators has introduced him again for one cause: to dealer a sale.

UiPath’s merchandise match squarely into the general AI image. Nonetheless, the corporate has steep competitors from megacap tech. This is the place I see Dines taking part in an enormous position.

One potential acquirer for UiPath might be Microsoft. The Home windows developer has invested billions into OpenAI, the start-up behind ChatGPT. During the last yr, Microsoft has built-in ChatGPT throughout its ecosystem, significantly on its Azure cloud computing platform and its office productiveness instruments.

I feel that UiPath’s RPA software program might complement Microsoft’s current office automation providers. Furthermore, contemplating that Dines used to work at Microsoft within the early 2000s, I feel there’s good potential for the businesses to associate up.

Apart from Microsoft, I feel Salesforce might be a possible suitor for UiPath. Salesforce is a extremely acquisitive firm, having spent tens of billions shopping for companies reminiscent of MuleSoft, Tableau, and Slack. Every of those property helped broaden Salesforce’s capabilities past buyer relationship administration software program. UiPath presents an fascinating new layer for Salesforce and might improve the corporate’s current line of AI-powered productiveness instruments.

The final firm I feel could be all for UiPath is ServiceNow, a number one IT workflow administration platform. ServiceNow operates throughout a large spectrum of generative AI functions, one among which is RPA.

Whereas this provides the corporate an apparent overlap with UiPath, I ought to observe that ServiceNow just isn’t almost as acquisitive as Microsoft or Salesforce. The corporate has principally grown organically, making quite a lot of smaller acquisitions in comparison with its huge tech cohorts above.

It is necessary to notice that the concepts explored above are my very own. UiPath might very effectively enter right into a turnaround and emerge as a a lot stronger firm than it’s immediately. Furthermore, I’d not encourage buyers to purchase shares of UiPath over hypothesis that it might be acquired.

It doesn’t matter what occurs, one factor is definite: UiPath is at a extremely fascinating juncture proper now. I am excited to see what occurs and study extra from administration over the approaching quarters.

Must you make investments $1,000 in UiPath proper now?

Before you purchase inventory in UiPath, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and UiPath wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $741,362!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 3, 2024

Adam Spatacco has positions in Microsoft. The Motley Idiot has positions in and recommends Microsoft, Salesforce, ServiceNow, and UiPath. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

Prediction: This Artificial Intelligence (AI) Company Will Be Acquired by Next Year was initially printed by The Motley Idiot