The proliferation of synthetic intelligence (AI) turned out to even be a boon for some legacy tech firms in search of their subsequent massive development driver. Stalwarts like Oracle (NYSE: ORCL) and Dell Technologies (NYSE: DELL) have gained spectacular momentum on the inventory market of late.

Share costs of Oracle, which made its title promoting database software program, are up 34% up to now in 2024. Dell Technologies, which is within the retro enterprise of promoting computer systems and servers, has delivered gorgeous inventory value good points of practically 90% up to now this 12 months.

How did AI assist reignite investor curiosity in these shares? Extra importantly, which one among these tech giants must you contemplate shopping for proper now to capitalize on the AI increase? Let’s attempt to discover some solutions.

The case for Oracle

Enterprise software program and database options supplier Oracle has struggled to speed up its development these days. Within the not too long ago concluded fiscal 2024 (which ended on Might 31), Oracle’s annual income elevated simply 6% to $53 billion. That was a step down from the 22% income development to $50 billion it reported in fiscal 2023, although $5.9 billion of that got here from the acquisition of healthcare data expertise firm Cerner, which Oracle acquired at first of the fiscal 12 months.

Excluding that acquisition, Oracle’s prime line would have elevated within the low single digits in fiscal 2023. The excellent news is that the accelerated curiosity in AI opened a complete new development alternative for Oracle. Even higher, the corporate is already capitalizing on it. That is evident from the truth that Oracle’s remaining efficiency obligations (RPO), which refers back to the whole worth of an organization’s future contracts that it’s but to satisfy, jumped a strong 44% 12 months over 12 months within the fourth quarter of fiscal 2024 to $98 billion.

AI performed a central position on this large enchancment in Oracle’s income pipeline. That is as a result of the demand for Oracle’s generative AI cloud infrastructure is so sturdy that the corporate is quickly constructing extra of it to satisfy the identical. Extra particularly, the strong demand for cloud AI companies is now shifting the needle in a major means for Oracle. This was evident from CEO Safra Catz’s feedback on the newest earnings conference call:

Infrastructure cloud companies income was up 42%. Excluding legacy internet hosting, OCI Gen 2 Infrastructure cloud companies grew 44%, with an annualized income of $7.4 billion. OCI consumption income was up 53%. Have been it not for persevering with provide constraints, consumption development would have been even larger.

It’s price noting that Oracle is trying to aggressively add extra cloud capability “given the enormity of our backlog and pipeline.” Extra importantly, the cloud AI market represents a profitable and secular long-term development alternative for Oracle. Mordor Intelligence estimates that the cloud AI market might develop from an estimated income of $67 billion this 12 months to $275 billion in 2029.

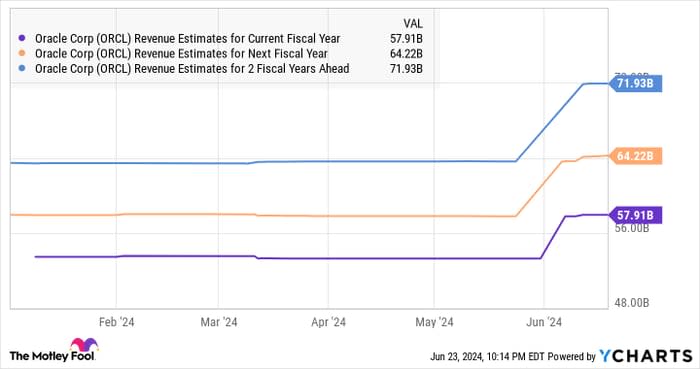

Oracle administration forecasts double-digit income development within the present fiscal 12 months, which might be an enchancment over its fiscal 2024 efficiency. Even higher, as the next chart tells us, its top-line development is anticipated to get higher over the subsequent couple of fiscal years as effectively.

ORCL Revenue Estimates for Current Fiscal Year information by YCharts

All this means that Oracle might proceed to stay a prime AI inventory sooner or later because of its monumental backlog and the rising adoption of AI-focused cloud companies.

The case for Dell Technologies

Dell had a forgettable time in fiscal 2024 (which resulted in February this 12 months) as its prime line dropped 14% to $88.4 billion. The corporate was hit laborious by the weak demand for private computer systems (PCs) final 12 months, however issues have began altering for the higher within the new fiscal 12 months.

Dell’s fiscal 2025 Q1 income elevated 6% 12 months over 12 months to $22.2 billion. The corporate’s consumer options group (CSG) section, which struggled final 12 months on account of the weak PC market, delivered a flat income efficiency as in comparison with the prior-year interval. This section’s efficiency might enhance sooner or later because of the rising adoption of AI-enabled PCs.

Counterpoint Analysis factors out that roughly 75% of laptop computer PCs shipped in 2027 are going to be AI-enabled, which might be an enormous leap when in comparison with final 12 months when solely 13% of the laptop computer PCs have been able to working AI functions domestically. The general demand for AI-capable PCs is forecast to extend at an annual price of 44% by 2028.

Dell administration acknowledged this potential development alternative on its current earnings convention name, with COO Jeff Clarke mentioning, “The PC put in base continues to age. Home windows 10 will attain end-of-life later subsequent 12 months, and the trade is making important advances in AI-enabled architectures in functions.”

So, there’s a good likelihood that this section, the place Dell has discovered development troublesome to return by, is ready for a strong turnaround. On the identical time, the corporate’s infrastructure options enterprise noticed strong development on the again of wholesome demand for AI servers. Its income elevated 22% 12 months over 12 months to $9.2 billion within the earlier quarter, and the pattern is right here to remain as prospects line as much as buy Dell’s AI-optimized servers.

The corporate ended fiscal Q1 with a rise of greater than 100% in shipments of AI-optimized servers on a quarter-over-quarter foundation to $1.7 billion. Extra importantly, it obtained $2.6 billion price of AI server orders final quarter and presently has a backlog of $3.8 billion that it’s but to satisfy. That is one other red-hot development alternative for Dell as the marketplace for AI servers is anticipated to generate a whopping $430 billion in annual income in 2033, up from simply $31 billion final 12 months.

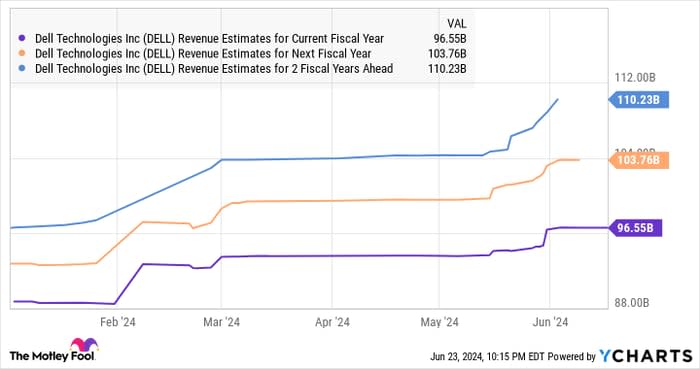

So, similar to Oracle, even Dell is sitting on profitable AI-related catalysts, which is the explanation why analysts have been elevating their development expectations from the corporate.

DELL Revenue Estimates for Current Fiscal Year information by YCharts

The decision

For those who’re on the hunt so as to add an AI inventory to your portfolio, which one among these two tech giants is a greater wager proper now?

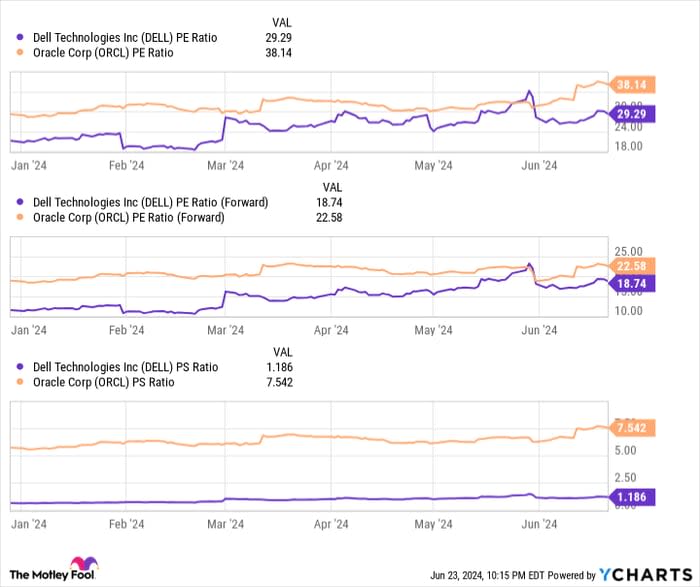

Regardless that Dell inventory jumped impressively in 2024 and outperformed Oracle by a large margin available on the market, it nonetheless trades at a considerably cheaper valuation (see chart under). It is usually price noting that Dell looks like a extra diversified AI funding as it’s set to capitalize on the demand for AI-enabled PCs and servers.

DELL PE Ratio information by YCharts

Nonetheless, Oracle has a a lot larger backlog that might assist speed up its development in the long term. Additionally, its income pipeline might proceed to enhance because of the large income alternative within the cloud AI area.

So the higher inventory to select relies on the particular person shopping for. Traders contemplating these two AI stocks might want to select based mostly on their private threat profiles and the valuation they’re comfy with. Relying on the person’s scenario, both Dell or Oracle could possibly be the higher wager to profit from the proliferation of AI.

Must you make investments $1,000 in Oracle proper now?

Before you purchase inventory in Oracle, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Oracle wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $723,729!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Oracle. The Motley Idiot has a disclosure policy.